Exercise-8 (FIFO and LIFO under periodic and perpetual system)

Breeze Trading Company discloses the following information for the month of August 2016.

- Aug. 01: Beginning inventory, 600 units @ $5 each each.

- Aug. 10: Sold 400 units @ $12 each.

- Aug. 11: Purchased 1,600 units @ $6 each.

- Aug. 15: Sold 1,000 units @ $12.50 each.

- Aug. 20: Purchased 1,000 units @ $6.50 each.

- Aug. 27: Sold 600 units @ $13.50 each.

Required:

- Assume Breeze Trading Company uses periodic inventory system, compute cost of goods sold (COGS), ending inventory and gross profit under:

(a). FIFO

(b). LIFO - Assume Breeze Company uses perpetual inventory system, compute cost of goods sold (COGS), ending inventory and gross profit under:

(a). FIFO

(b). LIFO - Explain the reason of higher gross profit under FIFO than LIFO?

Solution:

(1) If Breeze Trading Company uses periodic inventory method:

Ending inventory in units = Beginning inventory + Purchases – Sales

= 600 units + 2,600 units – 2,000 units

= 1,200 units

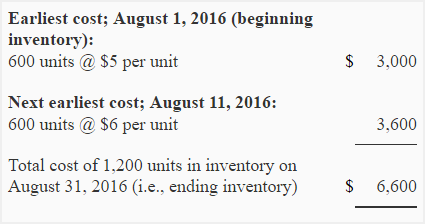

a. FIFO method:

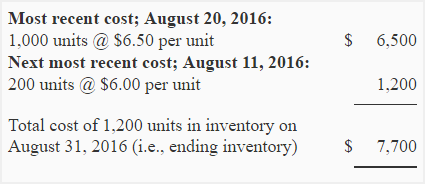

i. Cost of ending inventory under periodic-FIFO

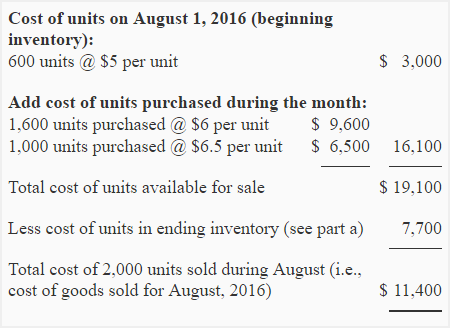

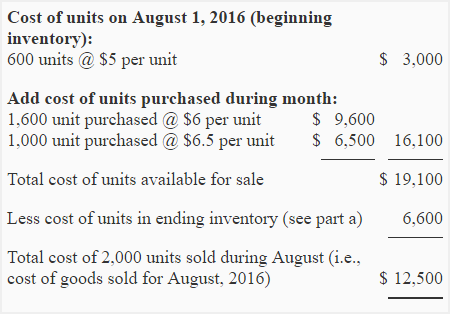

ii. Cost of goods sold under periodic-FIFO:

OR

iii. Gross profit under periodic-FIFO:

*(400 units × $12) + (1,000 units × $12.50) + (600 units × $13.50)

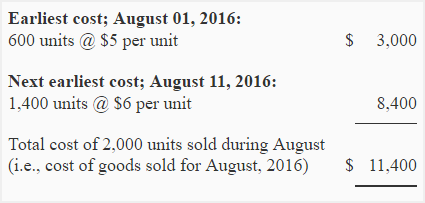

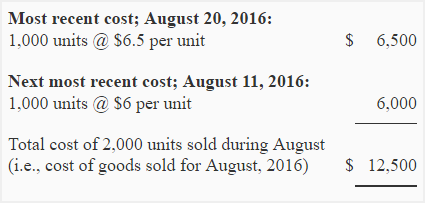

(b). LIFO method:

i. Cost of ending inventory under periodic-LIFO

ii. Cost of goods sold under periodic-LIFO:

iii. Gross profit under periodic-LIFO:

(2) If Breeze Trading Company uses perpetual inventory method:

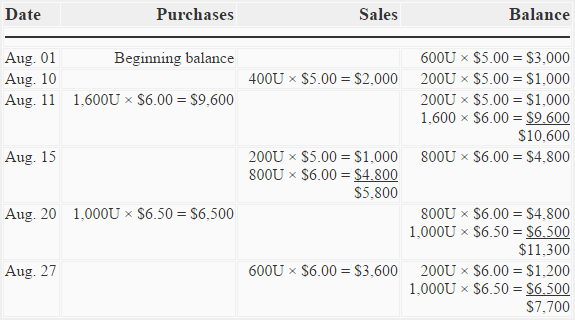

(a). Perpetual-FIFO:

We need to prepare a perpetual inventory card using FIFO method to find ending inventory, cost of goods sold and gross profit.

i. Cost of ending inventory under perpetual-FIFO:

$7,700 (see last row of balance column).

ii. Cost of goods sold under perpetual-FIFO:

$2,000 + $5,800 + $3,600 = $11,400 (total of sales column)

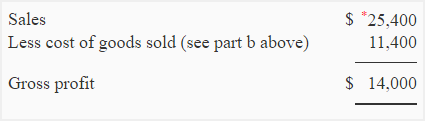

iii. Gross profit under perpetual-FIFO:

Sales – Cost of goods sold

= $25,400 – $11,400

= $14,000

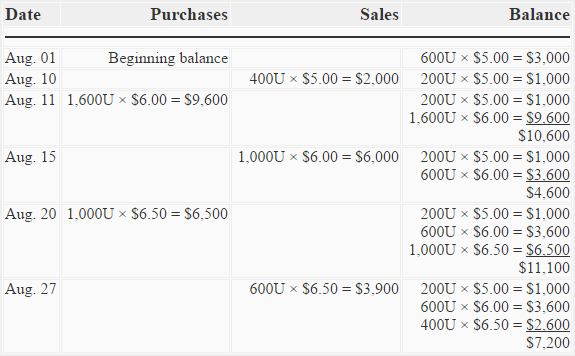

(b). Perpetual-LIFO:

We need to prepare a perpetual inventory card using LIFO method to find ending inventory, cost of goods sold and gross profit.

i. Cost of ending inventory under perpetual-LIFO:

$7,200 (see last row of balance column)

ii. Cost of goods sold under perpetual-LIFO:

$2,000 + $6,000 + $3,900 = $11,900 (total of sales column)

iii. Gross profit under perpetual-LIFO:

Sales – cost of goods sold

= $25,400 – $11,900

= $13,500

3. The reason of higher gross profit under FIFO than LIFO:

Under LIFO cost flow assumption, the most recent costs are matched against revenues, whereas under FIFO cost flow assumption, the oldest costs are matched against revenues. In inflationary environment (an economic situation where prices continuously rise), the FIFO produces higher gross profit than LIFO. The reverse is true in a deflationary environment (an economic situation where prices continuously decrease).

In this exercise, the prices are rising and the FIFO produces a higher gross profit than the LIFO method.

Leave a comment