Causes of difference in net operating income under variable and absorption costing

Variable costing and absorption costing usually produce different net operating income figures. The reason is that the fixed manufacturing overhead cost is not treated the same way under two costing methods. Under absorption costing approach, the fixed manufacturing overhead cost is included in the product cost, whereas under variable costing, the fixed portion of manufacturing overhead is not included in the product cost but is treated as a period cost and fully expensed as incurred each period.

To understand how this difference in treatment of fixed manufacturing overhead changes the net operating income figures under two costing systems, we need to prepare two income statements, one under variable costing and the other under absorption costing. For this purpose, consider the following example:

Example – cause of different net operating income under two costing approaches

Farabi Company prepares a variable costing income statement for the use of its internal management and an absorption costing income statement for the use of external parties like creditors, banks, tax authorities, etc. The company manufactures only one product that it sells at a price of $80 per unit. The variable and fixed cost data is given below:

Variable cost:

- Direct materials: $30.00 per unit

- Direct labor: $19.00 per unit

- Variable manufacturing over head cost: $6.00 per unit

- Variable marketing and administrative expenses: $4.00 per unit sold

Fixed cost:

- Fixed manufacturing overhead cost: $45,000 per month

- Fixed marketing and administrative expenses: $28,000 per month

During the month of June, 2023, 9,000 units were produced and 7,500 units were sold. The opening inventory was 2,000 units.

Required:

- Compute unit product cost under variable and absorption costing approaches.

- Prepare two income statements for Farabi Company, one using variable costing method and one using absorption costing method. Also prepare a schedule to reconcile the net operating income under two costing approaches.

- Explain the reason of difference in net operating income under two costing approaches.

Solution

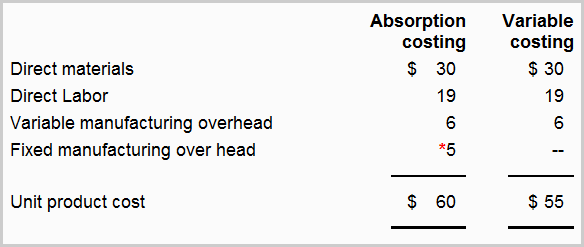

(1) Computation of unit product cost

*Per unit fixed manufacturing overhead cost:

= Fixed manufacturing overhead cost/Number of units manufactured

= $45,000/$9,000

= $5.00 per unit

(2) Preparation of income statements

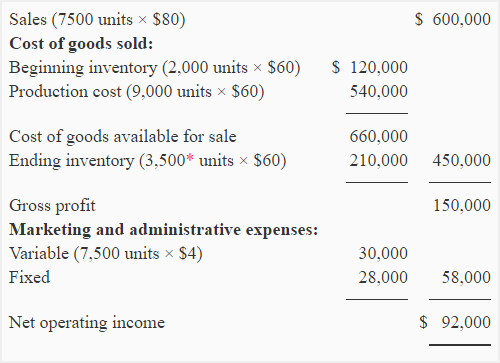

(a). Absorption costing income statement:

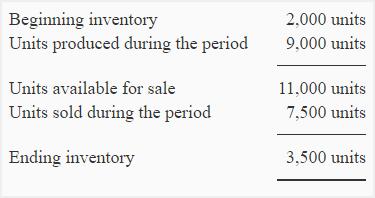

*The number of units in ending inventory has not been given in the question. However, we can easily obtain this number as follows:

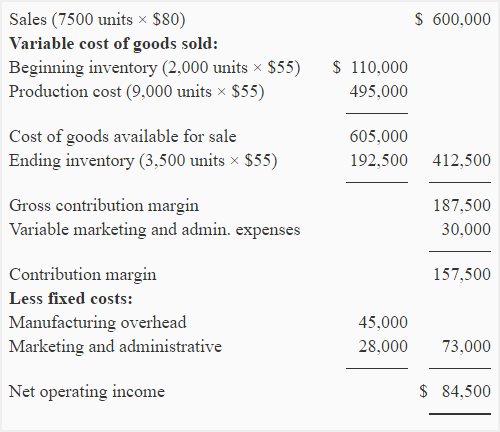

(b). Variable costing income statement:

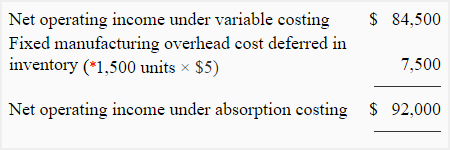

(c) Reconciliation of net operating income:

Since the inventory has increased by 1,500 units (3,500 units – 2,000 units) during June, a deferral of $7,500 (= 1,500 units x $5.00) of fixed manufacturing overhead in the inventory has taken place under the absorption costing approach. When a deferral of fixed manufacturing overhead occurs under absorption costing, as in this case, the easiest way to reconcile the net operating income is to arrive at absorption costing net operating income by adding the amount of deferred fixed manufacturing overhead to the variable costing net operating income. It can be done by preparing a simple reconciliation schedule like the one given below:

*Increase in inventory during June:

= Ending inventory – Beginning inventory

= 3,500 units – 2,000 units

= 1,500 units

(2). Explanation of the difference in net operating income:

Notice that the net operating income under absorption costing is $7,500 (= $92,000 – $84,500) higher than it is under variable costing. This difference is solely because of the deferral of fixed manufacturing overhead that has taken place under absorption costing but not under variable costing.

Under absorption costing, the ending inventory absorbs a portion of fixed manufacturing overhead and reduces the cost burden of the current period. Consequently, a portion of the fixed manufacturing overhead cost that relates to the current period is deferred to the next period. This is typically known as the deferring of fixed manufacturing overhead in the inventory. In our example, the amount of fixed manufacturing overhead deferred in the inventory is $7,500 as computed below:

Fixed manufacturing overhead deferred in inventory = Increase in inventory x Per unit fixed manufacturing overhead

= 1,500 units x $5

= $7,500

Notice that this deferral of fixed manufacturing overhead cost represents the difference in net operating income under two costing approaches.

In our example, the net operating income is higher under absorption costing than it is under variable costing because the units in ending inventory are higher than the units in beginning inventory (ie., the inventory has increased during the period). It has happened because the number of units produced is higher than the number of units sold during June. When inventory increases, as in this case, the fixed manufacturing overhead gets deferred in the inventory to later periods under absorption costing, reducing the cost burden of the current period.

In situations where the units in ending inventory are less than the units in beginning inventory (i.e., the sales exceeds production and the inventory decreases during the period), the fixed manufacturing overhead gets released from the inventory under absorption costing, increasing the cost burden of the current period. In such situations, the variable costing income statement would show a higher net operating income than the absorption costing income statement.

Under variable costing, the fixed manufacturing overhead cost is not included in the product cost but charged to the income statement of the current period in its entirety, just like selling and administrative costs. Since no portion of fixed manufacturing overhead is absorbed by the ending inventory under variable costing, the question of deferral or release of fixed cost does arise under this costing approach.

Important points to remember

Students always need to remember the following key points while solving their questions related to variable and absorption costing income statements:

- Under absorption costing, the fixed manufacturing overhead is essentially considered a product cost. Therefore, under this costing approach, the cost of each unit manufactured includes a portion of fixed manufacturing overhead in addition to all variable manufacturing costs.

- Under variable costing, the fixed manufacturing overhead is not considered the product cost. Rather, it is essentially considered a period cost and is fully expensed as incurred each period, along with other period costs like marketing and administrative expenses.

- When inventory increases during the period, the net operating income under absorption costing system is always higher than variable costing system.

- When inventory decreases during the period, the net operating income under variable costing systems is always higher than absorption costing system.

- When inventory increases, the fixed manufacturing overhead cost is deferred in inventory to the next period under absorption costing, which reduces the current period’s total cost burden.

- When inventory decreases, the fixed manufacturing overhead cost is released from inventory under absorption costing, which increases the current period’s total cost burden.

Thank you so much. Your example made everything crystal clear to me. I’m doing self study for CMA and this point was very technical. Really appreciate it.