Variable costing versus absorption costing

Variable costing and absorption costing are two different costing approaches that companies use for assigning cost to products, valuing inventories, and computing the cost of goods sold (COGS). These costing approaches are known by various names. For example, variable costing is also known as direct costing or marginal costing, and absorption costing is also known as full costing or traditional costing.

The information provided by the variable costing method is mostly used by internal management for decision making purposes. Absorption costing provides information that is used by both internal management and external parties like creditors, stockholders, government agencies, auditors, etc.

Variable costing and absorption costing cannot be substituted for one another because both have their own benefits and limitations. Large companies mostly use both of these costing approaches to fulfill the information needs of their internal management as well as external parties.

Let’s see how unit product cost is computed under these two costing approaches.

Variable costing vs absorption costing – computation of unit product cost

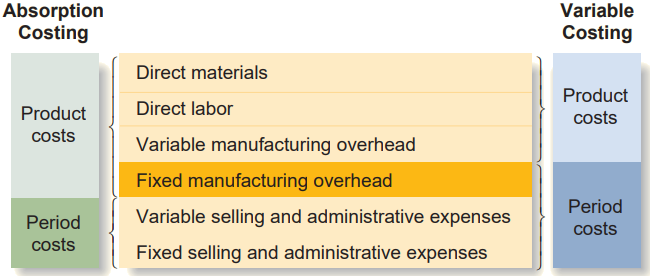

Under an absorption costing system, the product cost consists of all variable as well as fixed manufacturing costs, i.e., direct materials, direct labor, variable manufacturing overhead, and fixed manufacturing overhead. It means the unit product cost under absorption costing includes not only all variable manufacturing costs but also a portion of fixed manufacturing overhead. Since absorption costing considers all manufacturing costs as product costs, it is often referred to as full costing approach.

Under a variable costing system, the product cost consists of only those manufacturing costs that vary with production. Under this approach, the fixed component of manufacturing overhead is treated as a period or capacity cost and, therefore, not included in the product cost. It means the unit product cost under variable costing includes direct materials, direct labor, and only the variable portion of manufacturing overhead. Because the fixed portion of manufacturing overhead is not made part of the product cost under variable costing, it is entirely expensed as incurred each period, along with selling and administrative expenses. Variable costing is also referred to as marginal costing and direct costing.

The difference in treatment of fixed manufacturing overhead under variable and absorption costing results in different unit product costs under two costing systems. Hence, it leads to the different figures of the cost of goods sold, the cost of ending inventory, and, eventually, the net operating income (or loss) under two approaches.

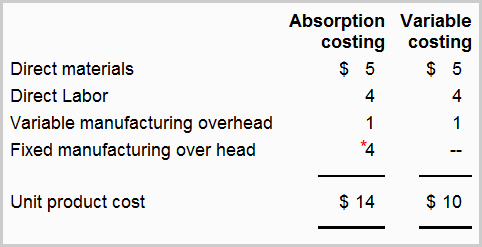

The following exhibition summarizes how the computation of unit product cost under two approaches differs:

Variable Costing vs Absorption Costing

For further clarification of the concept, consider the following examples:

Example 1 – computation of unit product cost

Peter Company manufactured 5,000 units of product X during the last month. The data about variable and fixed manufacturing cost of the company is as follows:

Direct materials: $5 per unit

Direct labor: $4 per unit

Variable manufacturing overhead: $1 per unit

Fixed manufacturing overhead: $20,000 per year

The unit product cost of Peter Company under two costing approaches can be computed as follows:

*Fixed manufacturing overhead/Number of units produced

= $20,000/5,000 units

= $4

Notice that the fixed manufacturing overhead cost has not been included in unit product cost under variable costing system, but it has been included under absorption costing system. This is the primary difference between variable and absorption costing approaches.

Example 2 – computation of unit product cost

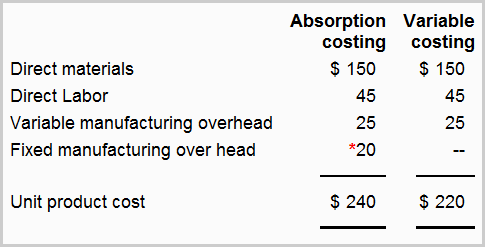

Sunshine, a small company, produces and sells only washing machines. The company uses variable costing to aid its internal management in decision making and absorption costing for external reporting. The data for the year 2023 is given below:

Direct materials: $150 per unit

Direct labor: $45 per unit

Variable manufacturing overhead: $25 per unit

Fixed manufacturing overhead: $160,000 per year

Fixed marketing and administrative expenses: $110,000 per year

Variable marketing and administrative expenses: $15 per unit sold

Sunshine produced 8,000 machines during the year 2023.

Required: Compute the unite product cost under variable costing and absorption costing. (Try to solve the question on your own before seeing the solution).

Solution:

*Fixed manufacturing overhead/Number of units produced

= $160,000/8,000 units

= $20

Note: Marketing and administrative expenses (both variable and fixed) are period costs and are, therefore, not relevant for the computation of unit product cost.

Now that we have learned the computation of unit product cost under variable and absorption costing, let’s see how the cost of goods sold and the ending inventory figures can be computed under two costing approaches. Consider the following example for this purpose:

Example 3 – computation of cost of goods sold and ending inventory figures

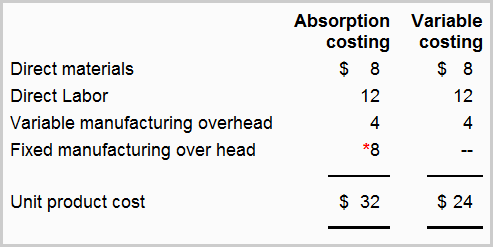

Martin Company manufactures a single product and has the following cost structure:

Variable costs per unit:

- Direct materials: $8

- Direct labor: $12

- Variable manufacturing overhead: $4

- Variable selling and administrative expenses: $6

Fixed costs per year:

- Fixed manufacturing over head: $40,000

- Fixed selling and administrative expenses: $25,000

Martin manufactured 5,000 units during the year 2023. Out of this production, the company sold 4,000 units to customers, and 1,000 units remained in stock as finished goods ending inventory. Martin started its operations on January 1, 2023, so it had no inventories on that date.

Required: On the basis of the above information, compute the cost of goods sold (COGS) and the cost of ending finished goods inventory, assuming Martin uses:

- an absorption costing approach

- a variable costing approach

Solution

Before we can obtain the cost of goods sold (COGS) and the cost of ending inventory figures under variable costing and absorption costing, we must compute the unit product cost under both costing approaches.

*Fixed manufacturing overhead/Number of units produced

= $40,000/5,000 units

= $8

1. When Martin Company uses an absorption costing approach:

(a). Cost of goods sold (COGS):

Number of units sold x Unit product cost under absorption costing

4,000 units x $32

= $128,000

(b). Cost of ending inventory:

Number of units in ending inventory x Unit product cost under absorption costing

1,000 units x $32

= $32,000

2. When Martin Company uses a variable costing approach:

(a). Cost of goods sold (COGS):

Number of units sold x Unit product cost under variable costing

4,000 units x $24

= $96,000

(b). Cost of ending inventory:

Number of units in ending inventory x Unit product cost under variable costing

1,000 units x $24

= $24,000

Note: Marketing and administrative expenses are period costs and have, therefore, been ignored while computing the cost of goods sold and ending inventory figures.

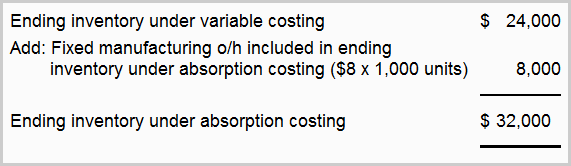

Notice that Martin’s cost of goods sold and cost of ending inventory figures under absorption costing are higher than they are under variable costing. This difference represents the portion of fixed manufacturing overhead that has been included in per unit cost under absorption costing but not under variable costing. For further clarification of this point, let’s reconcile both figures below:

Reconciliation of cost of goods sold (COGS) figure:

Reconciliation of ending inventory figure:

Important points to remember

Students should remember the following important points while working with variable and absorption costing approaches:

- Variable and absorption costing are two popular approaches that companies use for assigning costs to their products and computing the cost of goods sold (COGS).

- Variable costing is often preferred for internal reporting, while absorption costing is often mandatory for external reporting.

- Under variable costing, the fixed portion of manufacturing overhead cost is not included in the unit product cost. Therefore, the ending inventory and the cost of goods sold figures computed under this costing approach include only those manufacturing costs that vary with the output of the company. Under absorption costing, on the other hand, both variable and fixed manufacturing costs are made part of the unit product cost. Resultantly, the ending inventory and the cost of goods sold figures computed under this costing approach include all variable manufacturing costs as well as a portion of fixed manufacturing overhead.

In this lesson, we have mainly focused on the computation of the unit product cost, the ending inventory, and the cost of goods sold under variable and absorption costing. To learn and understand how a variable costing income statement differs from an absorption costing income statement, click on the next button below and read the next lesson.

There is a fine line, however clear that, only fixed manufacturing cost do not form part of variable costing.

all fixed costs (both manufacturing as well as non manufacturing) do not form part of variable cost but they are treated as period or capacity cost. Therefore, surplus is always more in variable costing income statement to that extent.