Exercise-8 (Shift in sales mix, break-even analysis of a multiproduct company)

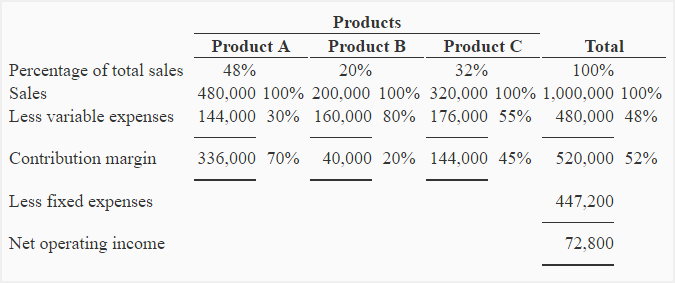

Digital World Company sells three products – Product A, Product B and Product C. The budgeted contribution margin income statement of the company for the coming month is given below:

Budgeted break-even point = Fixed expenses/CM ratio

= $447,200/0.52

= $860,000

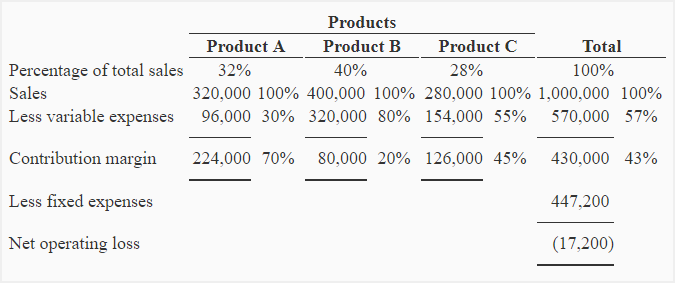

The actual sales data for the month is given below:

- Product A: $320,000

- Product B: $400,000

- Product C: $280,000

- Total actual sales for all products: $320,000 + $400,000 + $280,000 = $1,000,000

Required:

Compute the break-even point of Digital World Company based on the actual sales. Explain the reason of difference (if any) between the break-even point computed on the basis of budgeted sales and the break-even point computed on the basis of actual sales data.

Solution:

Before computing break-even point based on the actual sales, we need to prepare an income statement based on the actual sales.

Actual break-even point = Fixed expenses/CM ratio

= $447,200/0.43

= $1,040,000

The reason of difference in break-even point in dollar sales:

The difference in break-even point represents the shift in sales mix. A shift in sales mix from the products generating high contribution margin to the products generating low contribution margin decreased the overall contribution margin ratio of the company from 52% to 43% and hence increased the dollar sales required to break-even from $860,000 to $1,040,000.

Leave a comment