Net profit (NP) ratio

Net profit ratio (NP ratio) is a popular profitability ratio that shows the relationship between net profit after tax and net sales revenue of a business entity. It shows the amount of profit earned by an entity for each dollar of sales and is computed by dividing the net profit after tax by the net sales for the period concerned. Both the numbers needed to calculate this ratio can be taken from entity’s income statement or profit and loss account. Net profit ratio is also frequently referred to as profit margin on sales.

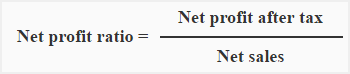

Formula

For the purpose of this ratio, net profit is the net income or net profit of the entity as exhibited by its income statement or profit and loss account. Unlike operating profit ratio which considers only operating profit, the numerator in net profit ratio is the profit number arrived at by considering all operating as well as non-operating revenues and expenses. The denominator used is, however, the net sales which is typically the entity’s primary source of revenue.

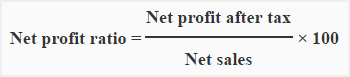

The relationship between net profit and net sales may also be expressed in percentage form. When it is shown in percentage form, it is known as net profit margin. The formula of net profit margin can be written as follows:

Examples of net profit ratio

Let’s first illustrate the calculation of net profit ratio through a couple of examples and then proceed to its significance and interpretation.

Example 1

The following data has been extracted from income statement of Zain & Maria corporation.

- Gross sales: $210,000

- Returns inwards: $10,000

- Net profit before tax: $50,000

- Income tax: 10%

Required: Compute net profit ratio of Zain & Maria corporation using above information.

Solution:

= ($45,000* / $200,000**)

= 0.225

or

=22.5%

*Net profit after tax:

= $50,000 – ($50,000 × 0.1)

=$50,000 – $5,000

= $45,000

** Net sales:

= $210,000 – $10,000

= $200,000

Example 2

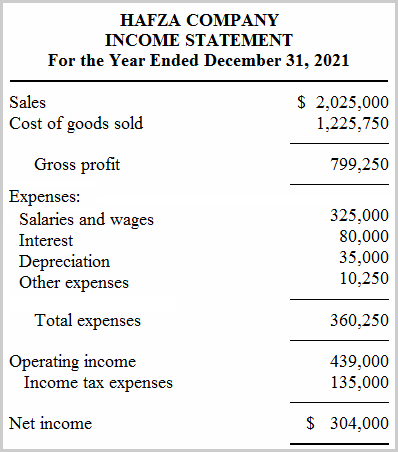

Hafza Company’s income statement for the year ended December 31, 2021 is presented below:

Required: Determine the net profit ratio of Hafza Company using the data from above income statement.

Solution

$304,000/$2,025,000

= 0.1501

or

= 15.01%

Significance and Interpretation

Net profit (NP) ratio can be a useful tool for measuring the overall profitability and operating performance of a commercial entity. A high ratio number indicates an efficient management of operational affairs of the entity and a low number might indicate otherwise.

There is no norm to interpret this ratio. To see whether a business is constantly improving its profitability or not, the analyst should compare the ratio with the previous years’ ratio, the industry’s average and the budgeted net profit ratio.

The use of net profit ratio in conjunction with assets turnover ratio helps in ascertaining how profitably the management has managed and used the entity’s resources during the period concerned.

Net profit ratio should be applied in your analysis with caution, because a low ratio may not always be a sign of bad operational performance. Entities would normally exhibit a low NP ratio when they purposely adopt an affordable or low-price strategy to grasp a larger market share. Such entities can improve their NP ratio only by doing some possible reduction in costs, because raising the price of their products or services would result in lost market share. These entities generally keep their focus on improving their absolute net profit number rather than the ratio value.

Another problem with net profit ratio is that it is not a long-term measurement of profitability. It is mostly calculated by using the numbers from a short-period (typically one year or less) operating result of the entity and, therefore. does not indicate anything about it’s ability to maintain operational performance on continuous basis. Moreover, an entity can temporarily improve its net profit ratio by delaying such expenditures which don’t have a significant immediate impact on profitability. For example, the management can intentionally postpone a periodic maintenance or similar other discretionary expenses to gain a higher profit number in current period and make the ratio temporarily look better.

Well-articulated