Assets turnover ratio

Assets turnover ratio is an activity ratio that measures the efficiency with which assets are used by a company. It is computed by dividing net sales by average total assets for a given period.

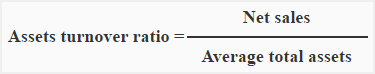

Formula:

Assets turnover ratio is computed by using the following formula:

The numerator includes net sales i.e., sales less sales returns and discount. The denominator includes average total assets. Average total assets are equal to total assets at the beginning of the period plus total assets at the ending of the period divided by two.

Example:

The following data has been taken from the financial statements of TATA industries:

- Gross sales: $65000

- Sales returns: $2,500

- Assets at the beginning of the year: $78,000

- Assets at the end of the year: $72,000

Required: Compute assets turnover ratio for the TATA industries.

Solution:

$62,500* / $75,000**

= 0.83

*65,000 – 2,500

**(78,000 + 72,000)/2

Assets turnover ratio of TATA industries is 0.83. It means every dollar invested in the assets of TATA industries produces $0.83 of sales.

Leave a comment