Gross profit (GP) ratio

Gross profit ratio (GP ratio) is a profitability ratio that shows the relationship between gross profit and total net sales revenue. It is a popular tool to evaluate the operational performance of the business. The ratio is computed by dividing the gross profit figure by net sales.

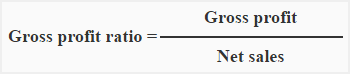

Formula:

The following formula/equation is used to compute gross profit ratio:

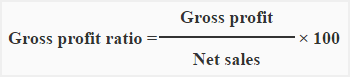

When gross profit ratio is expressed in percentage form, it is known as gross profit margin or gross profit percentage. The formula of gross profit margin or percentage is given below:

The basic components of the formula of gross profit ratio (GP ratio) are gross profit and net sales. Gross profit is equal to net sales minus cost of goods sold. Net sales are equal to total gross sales less returns inwards and discount allowed. The information about gross profit and net sales is normally available from income statement of the company.

Example:

The following data relates to a small trading company. Compute the gross profit ratio (GP ratio) of the company.

- Gross sales: $1,000,000

- Sales returns: $90,000

- Cost of goods sold: $675,000

Solution:

With the help of above information, we can compute the gross profit ratio as follows:

= (235,000* / 910,000**)

= 0.2582 or 25.82%

*Gross profit = Net sales – Cost of goods sold

= $910,000 – $675,000

= $235,000

**Net sales = Gross sales – Sales returns

= $1,000,000 – $90,000

= $910,000

The GP ratio is 25.82%. It means the company may reduce the selling price of its products by 25.82% without incurring any loss.

Significance and interpretation:

Gross profit is very important for any business. It should be sufficient to cover all operating expenses of the entity and provide for profit.

There is no norm or standard to interpret gross profit ratio (GP ratio). Generally, a higher ratio is considered better.

The ratio can be used to test the business condition by comparing it with past years’ ratio and with the ratio of other companies in the industry. A consistent improvement in gross profit ratio over the past years is the indication of continuous improvement in operation. When the ratio is compared with that of others in the industry, the analyst must see whether they use the same accounting systems and practices.

Leave a comment