Exercise-9: Effect of transactions on statement of cash flows – indirect method

Learning objective:

This exercise illustrates how various business activities impact a company’s statement of cash flows.

The following is a list of independent items. Explain how each item would affect the statement of cash flows under the indirect method.

- The company sold 20,000 shares of common stock for cash during the year. The stated value of shares was $10 per share, and the shares were issued at $35 per share.

- The accounts receivable amounting to $15,000 were written off during the year. The company uses the allowance method to account for uncollectible accounts expense.

- The company earned a net income of $37,500 for the year. A fixed asset was sold to a small firm for $15,000, which resulted in a loss of $2,500 because the book value of the asset on the date of sale was $17,500. The depreciation expense for the year was $8,500.

- The company purchased treasury stock costing $25,000 during the year.

- The company purchased a 3-month US Treasury Bill for $50,000.

- The company incurred a loss of $25,000 for the year. A tract of land costing $15,000 was sold at a gain of $4,000. The depreciation expense for the year was $12,000.

- During the year, a 50% interest in C&P Co. was acquired for $65,000. The transaction was fully settled by issuing the shares of common stock.

- During the year, the patent amounting to $5,000 was amortized.

Solution

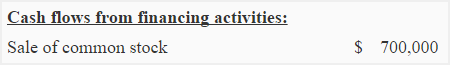

1. Sale of common stock:

The sale of common stock is a financing activity, and the inflow of cash resulting from it would be reported in the financing activities section of the statement of cash flows.

2. Write-off of accounts receivable:

The write-off of accounts receivable reduces the balances in “allowance for doubtful accounts account” and “accounts receivable account” but does not affect cash. Therefore, it is not reported in the statement of cash flows.

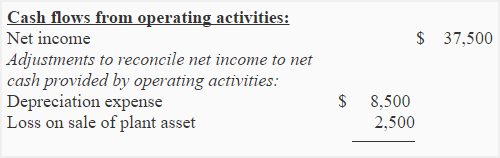

3. Sale of plant asset at a loss and depreciation expense:

The information provided in item number 3 would affect two sections of the statement of cash flows – the operating activities section and the investing activities section. A brief explanation of both effects is given below:

(a). Under the indirect method, the net income, depreciation expense, and loss on sale of fixed assets are reported in the operating activities section. The depreciation expense of $8,500 and the loss of $2,500 on the sale of plant assets are both non-cash expenses. They would be added to net income to arrive at net cash provided (or used) by operating activities. The usual presentation is illustrated below:

Note: The operating activities section illustrated above is only partial. It is based on the information available in item number 3 of the exercise. The net cash provided (or used) by operating activities would depend on all the items in this section.

(b). The total proceeds from the sale of plant asset (i.e., $15,000) would be reported in the investing activities section of the statement of cash flows, as illustrated below:

4. Purchase of treasury stock:

The purchase of treasury stock is a financing activity. The outflow of cash amounting to $25,000 as a result of the purchase of treasury stock would be reported in the financing activities section of the statement of cash flows.

5. Purchase of US Treasury bill:

The US Treasury Bill is considered a cash equivalent instrument. It is not reported on the statement of cash flows because its purchase does not change cash or cash equivalents.

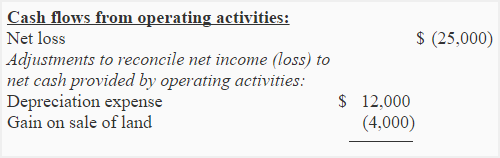

6. Sale of land at a gain and depreciation expense:

The explanation of item number 6 is similar to that of item number 3.

(a). The net loss, depreciation expense, and gain on the sale of land would be reported in the operating activities section as follows:

Note: The operating activities section illustrated above is only partial. It is based on the information available in item number 6. The net cash provided (or used) by operating activities would depend on all the items in this section.

(b). The total sale proceeds of land ($15,000 cost + $4,000 gain) would be reported in the investing activities section as follows:

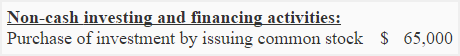

7. Investment in exchange of common stock:

The investment in C&P for the exchange of common stock does not involve any inflow or outflow of cash. It is a significant non-cash investing and financing activity that should be reported either at the bottom of the statement of cash flows as a footnote or as a separate note to the financial statements. The reporting at the bottom of the statement of cash flows is illustrated below:

Click here to read more about the disclosure of non-cash investing and financing activities.

8. Amortization of patents:

Under the indirect method, the treatment of amortization is similar to that of depreciation. The amortization of patent amounting to $5,000 is a non-cash expense that must be added back to net income to arrive at net cash provided by operating activities.

thank you for your great job

best regards,

Mohamed Hashem