Exercise-10: Computation of net cash flows from operating activities – indirect method

Learning objective:

This exercise illustrates the computation of a company’s net cash flows from its operating activities under the indirect method.

Exercise-10(a):

The following information has been taken from the income statement and balance sheet of Virginia Inc.

Income statement:

- Net income: $192,500

- Depreciation expense: $62,500

- Amortization of intangible assets: $20,000

- Gain on sale of equipment: $45,000

- Loss on sale of investments: $17,500

Balance sheet:

- Accounts receivable on January 1, 2024: $190,000

- Accounts receivable on December 31, 2024: $167,500

- Inventory on January 1, 2024: $287,500

- Inventory on December 31, 2024: $251,500

- Prepaid expenses on January 1, 2024: $5,000

- Prepaid expenses on December 31, 2024: $11,000

- Accounts payable on January 1, 2024: $205,000

- Accounts payable on December 31, 2024: $189,500

- Accrued expenses payable on January 1, 2024: $77,500

- Accrued expenses payable on December 31, 2024: $90,000

The accounts payable balances provided above relate to suppliers of merchandise only.

Required: Using the above information, compute the net cash flows from operating activities under indirect method.

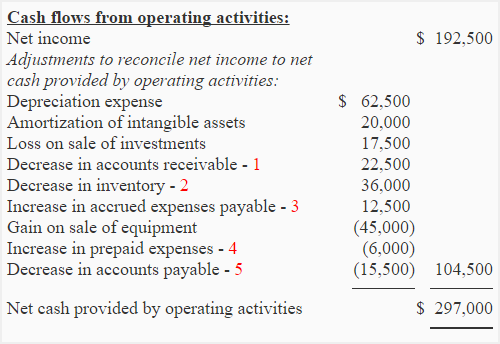

Solution:

The increases or decreases in working capital accounts have been computed below:

- 1 – Decrease in accounts receivable: $190,000 – $167,500

- 2 – Decrease in inventory: $287,500 – $251,500

- 3 – Increase in accrued expenses payable: $90,000 – $77,500

- 4 – Increase in prepaid expenses: $11,000 – $5,000

- 5 – Decrease in accounts payable: $205,000 – $189,500

Exercise-10(b):

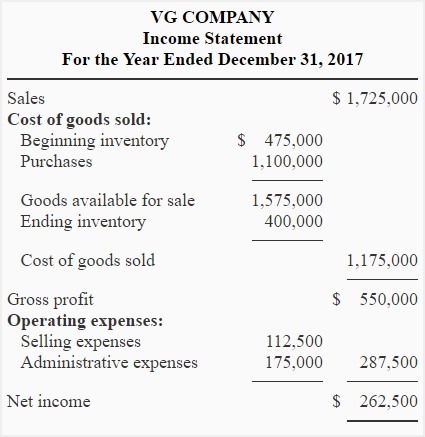

The income statement of VG Company for the year ended December 31, 2017 is given below:

The following additional information is also provided to you:

- The depreciation expense of $15,000 is included in the administrative expenses shown in the above income statement.

- Accounts receivable decreased by $90,000 during the year.

- Accounts payable decreased by $68,750 during the year.

- Prepaid expenses increased by $42,500 during the year.

- Accrued expenses decreased by $25,000 during the year.

You are requested to compute the net cash flow from operating activities of VG Company using the income statement and additional information given above.

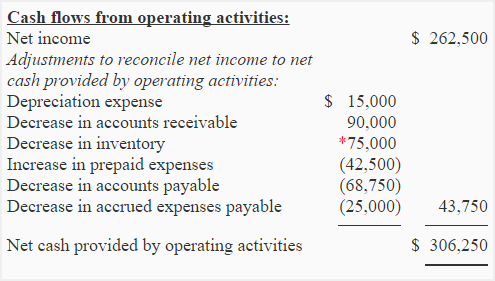

Solution

*Decrease in inventory has been computed by taking beginning inventory and ending inventory figures from the income statement:

= $475,000 – $400,000

= $75,000

Leave a comment