Exercise-11: Computation of cash paid for property, plant and equipment

Learning objective:

This exercise illustrates the computation of cash paid to acquire long-term fixed assets like property, plant, and equipment.

The C&T Corporation provides you the following information about its two balance sheet accounts at December 31, 2023 and 2024:

Equipment (at cost):

on December 31, 2023: $123,500

on December 31, 2024: $138,500

Accumulated depreciation – equipment:

on December 31, 2023: $83,500

on December 31, 2024: $89,000

The following additional information is available to you:

- During the year 2024, the equipment costing $22,500 was sold at a gain of $7,250. The book value of the equipment sold was $9,500.

- A piece of equipment was purchased for $10,000, and its payment was fully settled by issuing bonds payable.

Required:

- Compute the amount of cash paid for the purchase of equipment during the year 2024.

- How would the cash flows resulting from the sale and purchase of equipment be reported in the statement of cash flows?

Solution

1. Computation of cash paid for the purchase of equipment:

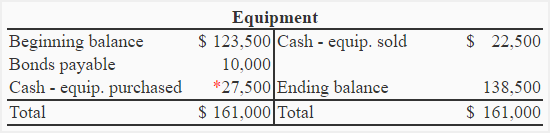

The cash paid for the purchase of equipment can be computed by preparing a T-account as follows:

*Cash paid for the purchase of equipment has been computed as the balancing figure of the T-account:

= ($138,000 + $22,500) – ($123,500 + $10,000)

= $27,500

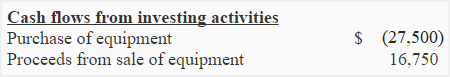

2. Reporting the sale and purchase of equipment in the statement of cash flows:

The cash paid for the purchase of equipment during the year is $27,000, and the proceeds from the sale of equipment during the year are $16,750 (= $9,500 cost + $7,250 gain). Both are investing activities and would be reported in the investing activities section of the statement of cash flows. The presentation of cash flows resulting from these two activities is illustrated below:

The simple method explained in this exercise can be used to compute the cash paid for any fixed asset.

The calculation for purchase of equipment for cash flow statement, was extremely clear on this site