Exercise-12: Computation of cash paid for dividends

Learning objective:

This exercise illustrates the computation of cash paid for dividends and its reporting in the statement of cash flows.

Exercise-12 (a):

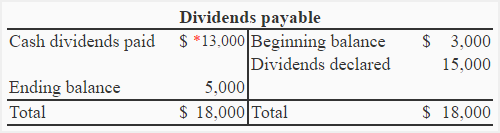

John Trading Center Inc. declared a $15,000 dividend during the year 2017. The dividends payable at the start and end of the year were $3,000 and $5,000, respectively. Determine the amount of cash paid for dividends by John Trading Center during the year 2017.

Solution

The cash paid for dividends can be determined by analyzing the T-account for dividends payable.

*The cash paid for dividend is the balancing figure of above account:

= $3,000 + $15,000 – $5,000

= $13,000

Exercise-12 (b):

Washington Company declared and paid cash dividends for 2017 and 2016 as shown below:

Required: On the basis of the above information, what amount would the company report in its statement of cash flows for the years 2017 and 2018?

Solution:

We report only those amounts in the statement of cash flows that are actually paid or received in cash or cash equivalents. A mere declaration of dividends does not impact the statement of cash flows because it does not involve any outflow of cash. It just impacts the balance in the retained earnings account. The outflow of cash occurs only when the payment is actually made to shareholders.

The dividends amounting to $200,000 declared in 2016 were paid in 2017. This payment would be reported in the financing activities section of the statement of cash flows for the year 2017.

The dividends amounting to $160,000 declared in 2017 were paid in 2018. This payment would be reported in the financing activities section of the statement of cash flows for the year 2018.

Exercise-12 (c):

Peterson Corporation earned a net income of $15,500 for the year 2024. It also provides you the following information about dividends payable and retained earnings accounts at the end of the year 2023 and 2024.

- Dividends payable on December 31, 2023: $2,500

- Dividends payable on December 31, 2024: $4,000

- Retained earnings on December 31, 2023: $45,500

- Retained earnings on December 31, 2024: $52,000

Required: Compute cash paid for dividends during the year 2024. How Peterson Corporation would report this payment on its statement of cash flows for the year 2024?

Solution

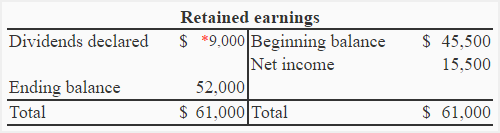

The cash paid for dividends can be computed by preparing T-accounts for retained earnings and dividends payable.

*Dividends declared is the balancing figure of the retained earnings account:

= $45,500 + $15,500 – $52,000

= $9,000

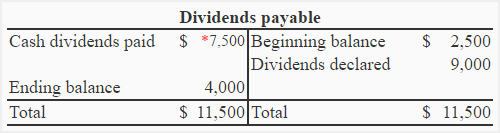

*Cash dividends paid is the balancing figure of the dividends payable account:

= $2,500 + $9,000 – $4,000

= $7,500

Leave a comment