Exercise 16: Cost of production report – materials added in 3rd department

Learning objective:

This exercise illustrates a situation where the materials are added in the last department, which increases the number of units to double.

All Well Company produces a product known as Product V5. This product is processed through three different processing departments. Additional materials are added in the 3rd Department, as a result of which the number of units is doubled in this department.

The following data belongs to Department 3 for April, 2020:

Quantity:

- Units received from Department 2: 10,000 units

- Units transferred to finished goods storeroom: 16,000

- Units still in process at the end of April: 4,000 units

Cost:

- Cost transferred in from Department 2 during April: $15,000

- Cost added by Department 3 during April:

– Materials: $4,400

– Labor: $4,500

– Factory overhead: $3,600

There was no work in process inventory on April 1, 2020. A weighted average costing method is used.

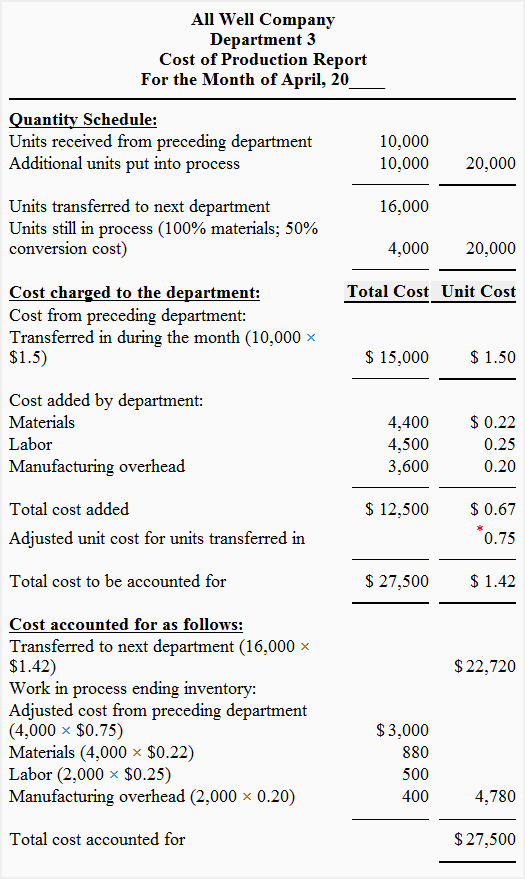

Required: Using the data provided by All Well Company, Prepare a cost of production report for April for Department 3.

Solution

*Adjusted unit cost for units transferred in:

As the number of units has increased in Department 3, the unit cost of the preceding department needs to be adjusted as follows:

= Cost from department 2/(Units received from department 2 + Units added by department 3)

= $15,000/(10,000 units + 10,000 units)

= $0.75 per unit

Equivalent units and unit cost:

Equivalent units:

Materials:

= 16,000 + 4,000

= 20,000 units

Labor and overhead:

= 16,000 + (4,000 × 50%)

= 16,000 + 2,000

= 18,000 units

Unit cost:

Materials:

= $4,400/20,000 units

= $0.22 per equivalent unit

Labor:

= $4,500/18,000 units

= $0.25 per equivalent unit

Manufacturing overhead:

= $3,600/18,000 units

= $0.20

Leave a comment