Exercise 15: Cost assigned to work in process inventory

Learning objective:

This exercise illustrates the computation of cost assigned to work-in-process inventory under weighted average and FIFO method.

The manager of Delta Company is interested in knowing the work-in-process inventory figures. The relevant data is given below:

- Work in process beginning inventory:

16,000 units – 100% complete as to materials and 50% complete as to conversion costs - Cost of beginning inventory:

materials 7,968; labor $4,296; overhead $4,296. - Started in process:

40,000 units - Cost added during the period:

materials $48,000; labor $39,936; overhead $39,936. - Completed and transferred out:

84,000 units - Work in process ending inventory:

12,000 units – 100% complete as to materials and 60% complete as to conversion cost

Required: Compute the cost assigned to work-in-process ending inventory, assuming the company uses:

- a weighted average method

- a FIFO method

Solution

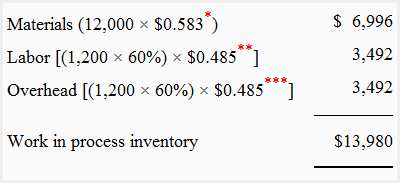

1. Cost assigned to work in process inventory – weighted average method

Equivalent units in ending inventory:

Materials:

= 84,000 + 12,000

= 96,000 units

Labor and overhead:

= 84,000 + 12,000 × 60%

= 84,000 + 7,200

= 91,200 units

Unit cost:

*Materials:

= ($7,968 + $48,000)/96,000 units

= $0.583

**Labor:

= ($4,296 + $39,936)/91,200 units

= $0.485

***Overhead:

= ($4,296 + $39,936)/91,200 units

= $0.485

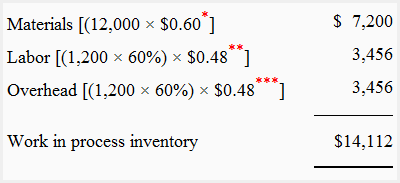

2. Cos assigned to work in process inventory – FIFO method

Equivalent units in ending inventory

Materials:

= 84,000 – 16,000 + 12,000

= 80,000 units

Labor and overhead:

= (84,000 – 16,000) + (16,000 × 50%) + (12,000 × 60%)

= 83,200 units

Units cost

*Materials:

= $48,000/80,000 units

= $0.60

**Labor:

= $39,936/83,200 units

= $0.48

***Overhead:

= $39,936/83,200 units

= $0.48

Leave a comment