Exercises 14: Equivalent units in process costing

Learning objective:

This exercise illustrates how the computations of equivalent units differ between the weighted average and the FIFO method.

Exercises 14 (a): equivalent units in process costing – weighted average vs FIFO:

On April 1, 2020, Proton Company had 40,000 units in its work-in-process inventory, 100% complete with respect to materials and 20% complete with respect to conversion cost. During April, 320,000 units were started in Department X. 340,000 units were transferred to Department Y during the month. On April 30, 2020, the company had 20,000 units in its work-in-process inventory, 100% complete as to materials and 40% complete as to conversion cost.

Required: Compute the equivalent units of production for Department X, assuming Proton uses:

- a weighted average method

- a FIFO method

Solution

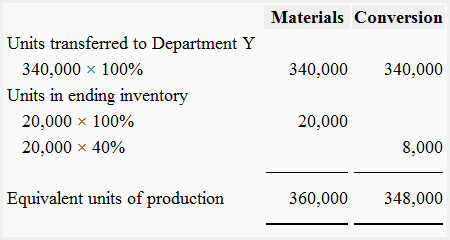

1. If Proton Company uses a weighted average method:

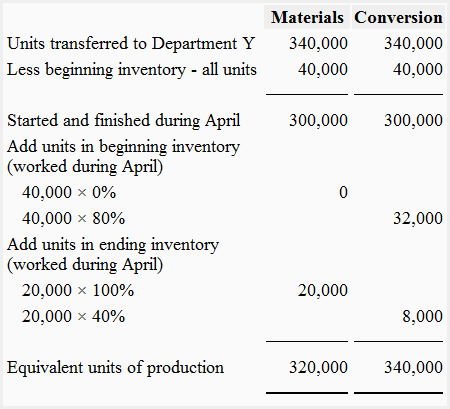

2. If Proton Company uses a FIFO method:

Exercise 14 (b): equivalent units in process costing – weighted average:

Galaxy Inc. produces a single product known as product T-9. To account for the production costs of product T-9, the company uses a proper process costing system. Galaxy has three processing departments – Department K, Department L, and Department M. The raw materials are put into process in department K, where they are partially processed and transferred to department L for further work. Packaging is done in department M, after which the finished products are moved to the finished goods storeroom area.

The following inventory of product T-9 is on hand at the end of December 31, 2020:

Department K:

- Number of units: 600 units

- Stage of completion: raw materials 1/3 complete; direct labor 1/2 complete

Department L:

- Number of units: 2,000

- Stage of completion: direct labor 2/5 complete

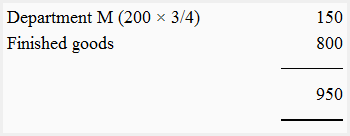

Department M:

- Number of units: 200

- Stage of completion: Packaging materials 3/4 complete; direct labor 1/4 complete

Finished goods:

- 800 units

There was no inventory of unused raw materials and packaging materials as of December 31, 2020.

Required:

- Compute the equivalent units for raw materials in all inventories on December 31, 2020.

- Compute the equivalent units for Department K’s direct labor in all inventories on December 31, 2020.

- Compute equivalent units for packaging materials in all inventories on December 31, 2020.

Solution

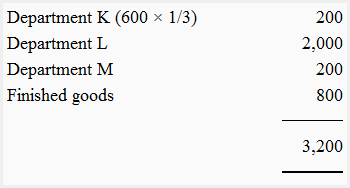

1. Equivalent units for raw materials in all inventories – December 31, 2020:

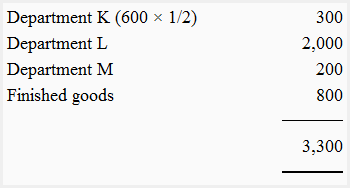

2. Equivalent units for department K’s direct labor in all inventories – December 31, 2020:

3. Equivalent units for packaging materials in all inventories – December 31, 2020:

Leave a comment