Prime cost and conversion cost

In manufacturing sector, the basic production costs can be categorized differently depending on the purpose and use of categorization. For example, they are often categorized as prime cost and conversion cost. This categorization is helpful in determining the efficiency of manufacturing facilities and processes in producing their output.

The terms prime cost and conversion cost are mainly used in a manufacturing environment; they are not relevant to merchandising companies because they just buy and sell ready to use product inventory and don’t produce anything.

- Prime cost – definition, explanation and formula

- Conversion cost – definition, explanation and formula

- Examples – application of formulas and calculations

Prime cost

Definition and explanation

Prime cost is the sum total of all direct manufacturing costs i.e., the costs that we can directly trace and associate to a unit of production. In contrast, the costs that we can’t reliably trace and associate to a unit of output are referred to as indirect costs and such costs don’t make part of the prime cost.

In a typical manufacturing process, direct manufacturing costs include direct materials and direct labor. However, they may also include the cost of supplies that are directly used in production process, and any other direct expenses that don’t fall under direct materials and direct labor categories.

The prime cost figure is helpful in determining a price level that can easily generate enough profit for the company.

Prime cost formula

The prime cost formula or equation can be written as follows:

The two components of prime cost formula are direct materials and direct labor. Both of these are considered direct costs.

Direct materials is the basic physical ingredient, matter or substance which the company processes to make a salable product. Plastic, rubber, steel, iron, timber and many agricultural outputs like sugarcane, sugar beets, jute and cotton etc. are examples of direct materials that are processed to produce salable finished products.

Direct labor is the cost that a manufacturing entity incurs for wages, salaries and benefits provided to production workers i.e., the workers who directly and physically handle the manufacturing process in a facility. Examples of direct labor workers include welders, machine operators, assemblers and painters etc.

A periodical review of the firm’s prime cost is crucial to ensure the efficiency of its manufacturing process. The computational responsibility lies with the factory manager who collects the relevant data, calculates the prime cost figure for the period and reports the same to operations manager for review.

The expenses and remunerations attached to workers and employees who merely support the production facility and are not actively involved in converting materials into ultimate product are not included in direct labor cost. Rather, such expenses are considered as indirect labor which goes to the entity’s total manufacturing overhead cost (discussed later in this article). Examples of such expenses include the salaries of production supervisor and factory watchman etc.

Conversion cost

Definition and explanation

Conversion cost, as the name implies, is the total cost that a manufacturing entity incurs to transform or convert its direct materials into salable or finished product. Typically, it is equal to the sum of entity’s total direct labor cost and total manufacturing overhead cost.

The conversion cost, when used in conjunction with prime cost, helps reduce waste and gauge other operational inefficiencies that may be present within the manufacturing facility.

Conversion cost formula

The conversion cost formula or equation is presented below:

Direct labor and manufacturing overhead costs are the two components of conversion cost formula. The direct labor component is the same as described and used in prime cost formula presented above. The total manufacturing overhead cost consists of all costs needed to run the manufacturing operations in factory that are not covered by the direct cost definition (i.e., direct materials, direct labor and any other direct expense). It is an indirect cost which means it can’t be reliably traced and associated to a unit of finished product.

Numerous manufacturing overhead costs are encountered in manufacturing facilities and processes. Rent of factory building, electricity, gas and coal used in production, salaries of production managers, depreciation of production machines and equipment are a few examples of these costs.

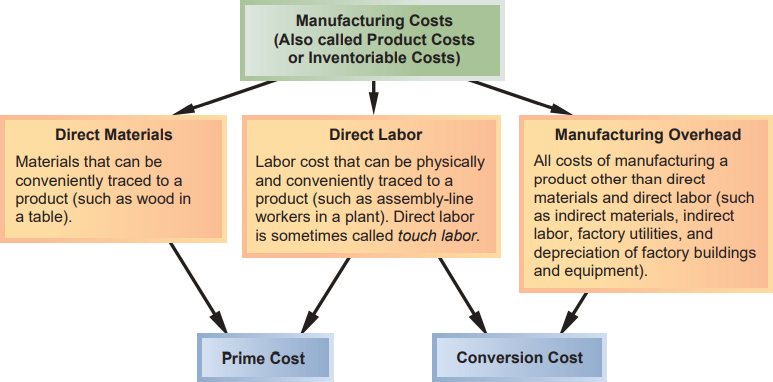

A summary of the prime cost and conversion cost concepts explained above is given below:

Examples of prime cost and conversion cost

In all the solutions below, the five cost terms have been abbreviated as follows:

- DMC = Direct materials cost

- DLC = Direct labor cost

- MOC = Manufacturing overhead cost

- PC = Prime cost

- CC = Conversion cost

Example 1

During October, KPK Inc. incurred the following costs in one of its manufacturing facility located in Alaska:

- Direct materials: $820,000

- Direct labor: $400,000

- Manufacturing overhead: $500,000

Required: Using the above data, compute the prime cost and conversion cost of Alaska manufacturing facility of KPK Inc.

Solution:

PC = DMC + DLC

= $820,000 + $400,000

= $1,220,000

CC = DLC + MOC

= $400,000 + $500,000

= $900,000

Example 2

In May 2020, Roberts Furniture House worked exclusively to complete a job of 10 office tables. The cost data relevant to this job is given below:

- Timber purchased and used during May: $5,500

- Glue and nails used: $200

- Sheets of glass purchased and used: $1,500

- Finishing materials used: $800

- Direct labor cost (200 hours @ $30 per hour): $6,000

- Indirect materials used for this job: $500

- Electricity charges allocable to this job: $1,000

- Engineering and supervision salaries: $2,500

Required: Work out the prime cost and conversion cost of Robert Furniture House.

Solution:

PC = DMC + DLC

= $8,000* + $6,000

= $14,000

CC = DLC + MOH

= $6,000 + $4,000**

= $10,000

*Direct materials used: Timber + Glue and nails + Glass + Finishing materials

= $5,500 + $200 + $1,500 + $800

= $8,000

**Manufacturing overhead: Indirect materials + Electricity + Engineering and supervision salaries

= $500 + $1,000 + $2,500

= $4,000

Timber, glue, nails, glass and finishing materials have been treated as direct materials because they all become part of finished and ready to sell table.

Indirect materials, electricity charges and salaries of engineer and supervisor are all indirect costs and have, therefore, been added together to obtain total manufacturing overhead cost.

Example 3

During June, Excite Company’s prime cost was $325,000 and conversion cost was $300,000. Total manufacturing overhead cost was $160,000.

Required: Compute the total direct materials cost of Excite Company for June.

Solution:

To know the direct materials cost incurred in June, we need to find out the direct labor cost first. We can do that by applying the conversion cost formula as follows:

CC = DLC + MOC

$300,000 = DLC + $160,000

DLC = $300,000 – $160,000

DLC = $140,000

Now that we have worked out the direct labor cost figure, we can apply the prime cost formula to compute the direct materials cost for June as follows:

PC = DMC + DLC

$325,000 = DMC + $140,000

DMC = $325,000 – $140,000

DMC = $185,000

Leave a comment