Exercise-21: Net present value (NPV) method with income tax

Learning objective:

Income tax implications can dramatically impact the capital budgeting decisions of a company’s management. This problem illustrates how to incorporate the impact of income tax into the computation of a project’s net present value (NPV).

A mining company is considering to open a new coal mine. The company has collected the following information about the cash flows associated with this project:

- Equipment needed for new mine: $900,000

- Working capital required for new mine: $210,000

- Expected annual cash inflow from the sale of coal: $750,000

- Expected annual cash expenses associated with the new mine: $500,000

- Road repairs required after 5 years: $110,000

The coal in the mine would be exhausted after 15 years. The equipment would be sold for its salvage value of $250,000 at the end of 15-year period. The company uses straight line method of depreciation and does not take into account the salvage value for computing depreciation for tax purpose. The tax rate of the company is 30%.

Required:

- Compute net present value (NPV) of the new coal mine assuming a 15% after-tax cost of capital.

- On the basis of your computations in requirement 1, conclude whether the coal mine should be opened or not.

Solution:

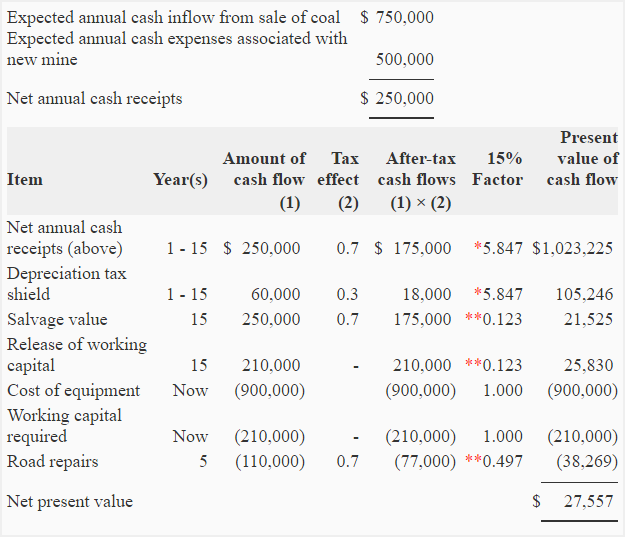

(1) Computation of net present value:

*Value from “present value of an annuity of $1 in arrears table“.

**Value from “present value of $1 table“.

(2) Conclusion:

Yes, the coal mine should be opened because its net present value (NPV) is positive.

Leave a comment