Exercise-20: Payback and accounting rate of return method

Learning objective:

This exercise illustrates the use of traditional payback period and accounting rate of return method of capital budgeting to evaluate the viability of investment in capital assets.

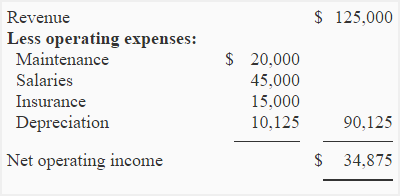

Euro Transport Company wants to purchase a new truck. The truck would cost $225,000 and its salvage value would be 10% at the end of its 20-year useful life. The annual estimated revenues and costs associated with the new truck are given below:

Required:

- Compute payback period of the truck. Is the investment in new truck desirable if maximum desired payback period of the company is 5 years? Assume that the depreciation is the only non-cash expense. Ignore income tax.

- Compute the accounting rate of return (ARR) promised by the truck. Would the company be interested to invest in new truck if its minimum required accounting rate of return is 12%? Ignore income tax.

Solution:

(1). Payback Analysis:

Payback period = Cost of the truck / Net annual cash inflows

= $225,000/$45,000*

= 5 years

*Depreciation is a non-cash expense and thus has been added back to the net operating income to obtain net annual cash inflows: $34,875 + $10,125 = $45,000

Because the payback period of truck is equal to the maximum desired payback period of Euro Transport Company, the investment is desirable.

(2). Accounting rate of return (ARR) Analysis:

Since ARR approach analyzes the project’s viability using incremental accounting income rather than its cash flow, we would not add back the depreciation expense to net operating income.

Accounting rate of return = Incremental net operating income/Initial investment

= $34,875/$225,000

= 15.5%

The accounting rate of return promised by truck is more than the accounting rate of return of Euro Transport Company. The investment in new truck is, therefore, desirable according to accounting rate of return analysis.

Leave a comment