Exercise-19: After-tax cost computation

Learning objective:

This exercise illustrates the computation of after-tax cost using a formula known as after-tax cost formula. It also illustrates the impact of inclusion of a tax deductible expense on the company’s net income before tax and income tax expense.

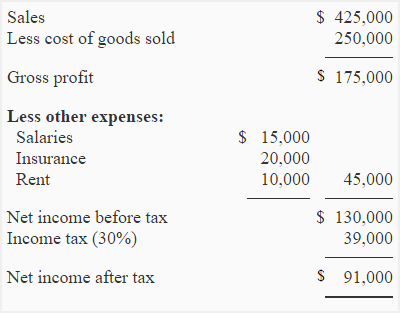

The projected income statement of Eastern Company is given below:

Eastern Company wants to start a training program that would cost $20,000 to the company. The training program is a tax deductible expense. The tax rate of the company is 30%.

Required:

- Prepare a new projected income statement of Eastern to show the effect of training program on both net income and income tax.

- What would be the after-tax cost of training program.

Solution:

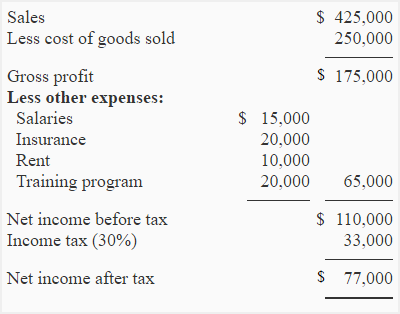

(1) Projected income statement with training program:

The effect of training program:

The inclusion of training program in “other expenses section” of revised projected income statement has lowered the net income before tax from $130,000 to $110,000. The reduction in net income before tax has decreased Eastern’s income tax expense from $39,000 to $33,000 – a saving of $6,000 in tax.

(2) Computation of after-tax cost of training program:

Because the training program is a tax deductible expense, it would reduce the company’s taxable income by $20,000 and income tax by $6,000 (= $39,000 – 33,000). The net of tax cost of training program would, therefore, be $14,000 (= $20,000 – $6,000).

Alternatively, we can compute the after-tax cost easily by using after-tax cost formula:

After-tax cost = (1 – tax rate) × Tax deductible expense

= (1 – 0.3) × $20,000

= 0.7 × $20,000

= $14,000

Leave a comment