Exercise-6: Net present value (NPV) with unequal proposal lives

Learning objective:

This exercise illustrates the comparison of two investment proposals with different or unequal lives using net present value (NPV) technique of capital budgeting.

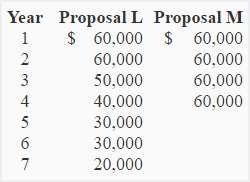

National Food Company is comparing two proposals – proposal L and proposal M. Proposal L has a useful life of 7 years whereas proposal M has a useful life of 4 years. Both the proposals require an equal initial investment of $180,000. The information about cash inflow expected from proposal L and proposal M is given below:

The management of National Food Company wants a 10% rate of return on capital investments.

Required: Compare two proposals using net present value method.

(Hint: An expert valuer estimates that the residual value of proposal L will be $60,000 at the end of Year 4).

Solution:

(1) Computation of net present value:

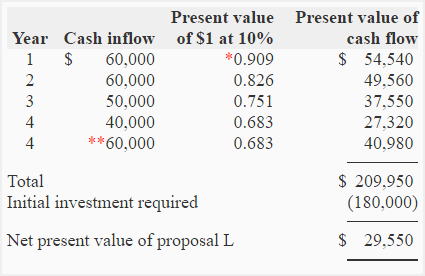

Since the two proposals have unequal useful lives, their net present values cannot be directly compared. To make the proposals comparable, we assume that proposal L is terminated at the end of year 4 which is the end of proposal M’s life. For this purpose, we have to estimate a residual value of proposal L and assume that the proposal is sold at that value at the end of year 4.

The net present value of proposal L and proposal M is computed below:

Net present value of proposal L:

- *Value from present value of $1 table.

- **Estimated residual value of proposal L at the end of 4th year. The residual (or salvage) value estimated at any point of time might not necessarily be the same as the total expected future cash inflow of the proposal. In fact, it might be a different amount. In this exercise, for instance, the total expected cash inflow of years 5, 6 and 7 is $80,000 (= $30,000 + $30,000 + $20,000) but we have estimated a residual value of $60,000 at the end of year 4. Such valuations are generally determined by an independent expert valuer or by the entity’s management itself.

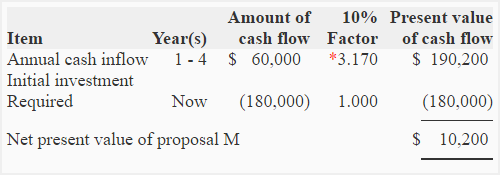

Net present value of proposal M:

*Value from present value of an annuity of $1 in arrears table.

(2) Decision:

Proposal L looks more desirable because its net present value is more than that of proposal M.

Leave a comment