Exercise-5: Present value index (PVI) for ranking investment proposals

Learning objective:

This exercise illustrates the computation and use of present value index (also known as profitability index) for ranking investment proposals.

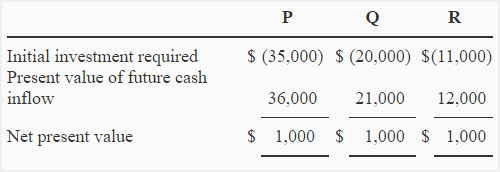

The management of National company is considering three competing investments – investment P, investment Q and investment R. The information about the requirement of initial amount of investment, present value of cash inflow and net present value of all three investments is given below:

Required:

- Calculate the present value index (PVI) of above three proposals.

- State your opinion regarding the acceptance or rejection of all three proposals on the basis of PVI computed in requirement 1. If the proposals are mutually exclusive, which one would you choose to invest in?

- Why can’t you depend on the traditional net present value (NPV) method to rank these proposals?

Solution:

1. Calculation of present value index (PVI):

Present value index = Present value of cash inflows/Initial investment

- Proposal P: $36,000/$35,000 = 1.03

- Proposal Q: $21,000/$20,000 = 1.05

- Proposal R: $12,000/$11,000 = 1.09

2. Decision of acceptance or rejection:

According to present value index rule, a proposal is viable if its PVI is greater than 1. From this perspective, we can see that all three proposals are acceptable because all have a PVI value of greater than 1. However, if these proposals are mutually exclusive, then proposal R is the most attractive one with highest PVI value of 1.09. According to present value index, the three proposals can be ranked as follows:

- R – (PVI value: 1.09)

- Q – (PVI value: 1.05)

- P – (PVI value: 1.03)

3. Why we can’t depend on traditional NPV method to rank proposals:

The traditional net present value method can be applied in preference ranking only when each proposal under consideration requires the same amount of investment. Since, in this question, each of three proposals requires a different amount of investment, we can’t use a traditional NPV approach for ranking purpose. The most suitable approach of ranking projects under such situations is the present value index (PVI) or profitability index (PI), as used to answer requirements 1 and 2 above.

Leave a comment