Exercise-5 (Variable and absorption costing income statement, reconciliation schedule)

Learning objective:

This exercise illustrates the preparation of income statement under absorption costing and variable costing. It also illustrates the reconciliation of net operating income under two costing approaches.

AGA Company manufactures and sells a product for $20 per Kg. The data for the year 2016 is given below:

- Sales in kgs: 75,000 kgs

- Finished goods inventory at the beginning of the period: 12,000 kgs

- Finished goods inventory at the closing of the period: 17,000 kgs

Manufacturing costs:

- Variable cost: $8 per Kg

- Fixed manufacturing overhead cost: $320,000 per year

Marketing and administrative expenses:

- Variable expenses: $2 per Kg of sale

- Fixed expenses: $300,000 per year

Required:

- Prepare income statement using absorption costing and variable costing methods.

- Prepare a reconciliation schedule to explain the cause of difference in net operating income under two costing approaches.

Solution

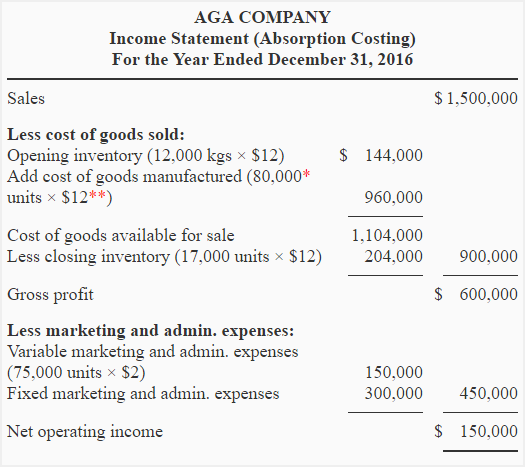

(1) Income statement:

(a) Absorption costing income statement:

*Production for the year 2016:

Units manufactured during 2016 = Units sold + Units in closing inventory – Units in opening inventory

= 75,000 kgs + 17,000 kgs – 12,000 kgs

= 80,000 kgs

**Manufacturing expenses per unit:

Variable expenses + Fixed expenses

= $8 + ($320,000/80,000 kgs)

= $8 + $4

= $12

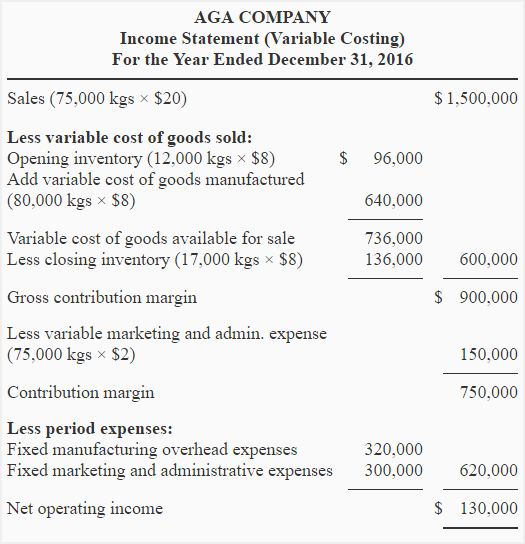

(b) Variable costing income statement:

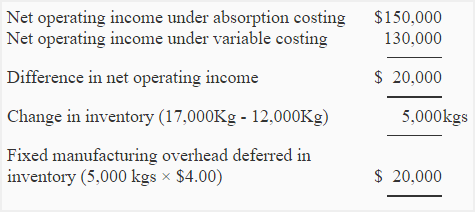

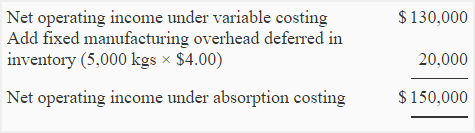

(2) Reconciliation schedule:

The net operating income under absorption costing is $20,000 more than it is under variable costing. When production exceeds sales (as in this exercise), the fixed manufacturing overhead is deferred in inventory to the next period under absorption costing. This deferral reduces the cost burden of the current period and causes a higher net operating income under absorption costing than under variable costing. The reconciliation of the net operating income under two costing approaches can be done in either of the following two ways:

Or

Leave a comment