Exercise-4 (Variable and absorption costing ending inventory, external reports)

Learning objective:

This exercise illustrates the computation of ending finished goods inventory under both variable and absorption costing. It also describes about which of these two inventory figures is appropriate for the purpose of external reporting.

The production and sales data of Albari Company for the year 2023 is as follows:

Variable costs per unit:

- Direct materials: $20

- Direct labor: $10

- Variable manufacturing overhead: $4

- Variable selling and administrative expenses: $8

Fixed costs per year:

- Fixed manufacturing overhead: $180,000

- Fixed selling and administrative expenses: $600,000

During the year 2023, Albari Company manufactured 30,000 units out of which 25,000 units were sold. At the end of 2023, the finished goods inventory account showed a balance of $170,000.

Required:

- What costing method is used by Albari to compute finished goods inventory?

- Should the company use finished goods inventory figure of $170,000 for external reports? If not, what is the correct amount in dollars that the company should use for external reporting purpose?

Solution:

(1) Costing method used by the company:

The ending inventory figure of $170,000 shows that Albari has not included the fixed manufacturing overhead cost for computing the total cost of its ending inventory. Therefore, we can conclude that the company has used a variable costing approach to determine its ending inventory. We can explain it by computing the unit product cost as well as the total ending inventory cost under variable costing system as follows:

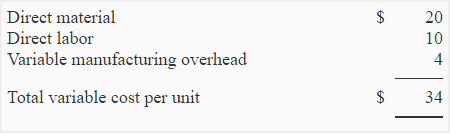

(i). Unit product cost under variable costing:

(ii). Ending inventory under variable costing approach:

Units in ending inventory × Per unit cost under variable costing

= 5,000 Units × $34

= $170,000

(2) Finished goods inventory figure for external reports:

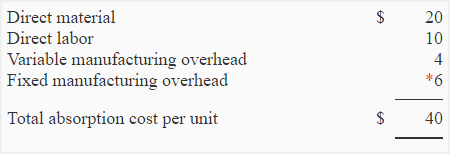

For external reporting purpose, Albari must use a finished goods inventory figure computed on the basis of absorption costing system. We can determine the absorption costing ending inventory figure by first determining the unit product cost under absorption costing approach and then multiplying the same by the number of units in the ending inventory.

(i). Unit product cost under absorption costing:

*$180,000/30,000 units = $6.00

(ii). Ending inventory under absorption costing approach:

Units in ending inventory × Per unit cost under absorption costing

= 5,000 Units × $40

= $200,000

Leave a comment