Exercise-3: Net cash provided/used by financing activities

Learning objective:

This exercise illustrates the computation of cash provided (or used) by financing activities and its reporting on the statement of cash flows.

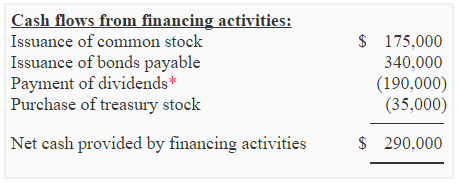

Exercise-3 (a):

The following activities were performed by L&M Corporation during the year 2023.

- Treasury stock purchased: $35,000

- Accounts payable paid: $585,000

- Note receivable collected: $50,000

- Dividends paid: $190,000

- Bonds payable issued: $340,000

- Common stock issued: $175,000

Required: Compute the net cash provided (or used) by financing activities to be reported on the statement of cash flows of L&M Corporation.

Solution:

Note: The following activities are not financing activities and have, therefore, not been included in the above computation:

- Payment to accounts payable.

- Collection of note receivable.

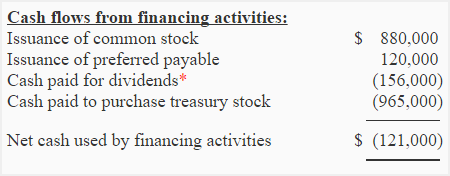

Exercise-3 (b):

Consider the following information of Ethnic Company:

- Sale of common stock: $880,000

- Sale of preferred stock: $120,000

- Payment of dividends: $156,000

- Purchase of treasury stock: $965,000

Required: Compute the net cash provided (or used) by financing activities using above information.

Solution:

*The payment of dividends is a financing activity under US-GAAP. For more details, read the “financing activities section of statement of cash flows”.

Leave a comment