Exercise-4: Cash paid to suppliers – formula approach

Learning objective:

This exercise illustrates the computation of cash paid to suppliers of inventory (also known as trade creditors) using the formula approach.

Exercise-4 (a):

Lucky Company uses the direct method to prepare its statement of cash flows and wants your assistance in computing the total cash paid to suppliers of inventory during the year 2023. The company presents you with the following information about its inventory, accounts payable, and cost of goods sold (COGS) for the year 2023:

- Inventory on January 1, 2023: $40,000

- Inventory on December 31, 2023: $75,000

- Accounts payable on January 1, 2023: $22,000

- Accounts payable on December 31, 2023: $35,000

- Cost of goods sold for the year 2023: $350,000

Required: Compute the total cash paid to suppliers of inventory by Lucky Company during the year 2023.

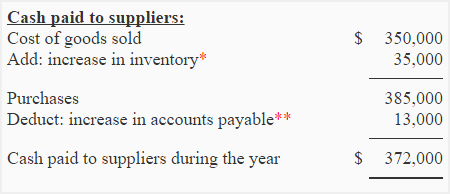

Solution:

*Increase in inventory during the period:

= $75,000 – $40,000

= $35,000

**Increase in accounts payable during the period:

= $35,000 – $22,000

= $13,000

Exercise-4 (b):

Metro Company’s cost of goods sold for the current year is $145,000. The beginning and ending balances of its merchandise inventory and accounts payable are given below:

- Merchandise inventory at the beginning of the year: $40,000

- Merchandise inventory at the end of the year: $32,000

- Accounts payable at the beginning of the year: $29,000

- Accounts payable at the end of the year: $15,000

Required: Using the above information, compute the total cash paid to suppliers of inventory by Metro Company during the period.

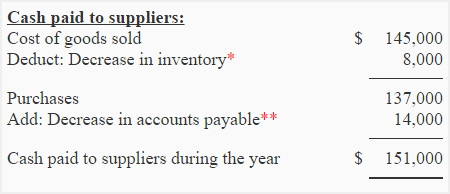

Solution:

*Decrease in inventory during the period:

= $40,000 – $32,000

= $8,000

**Decrease in accounts payable during the period:

= $29,000 – $15,000

= $14,000

Leave a comment