Exercise-2 (Break-even analysis of a multiproduct company)

PQR Company sells two products – product A and product B. The total fixed expenses of the company are $1,197,000. The monthly data of PQR is as follows:

Product A:

- Sales: $1,400,000

- Contribution margin ratio: 60%

Product B:

- Sales: $600,000

- Contribution margin ratio: 70%

Required:

- Prepare contribution margin income statement for the company.

- Calculate break-even point in dollars.

Solution:

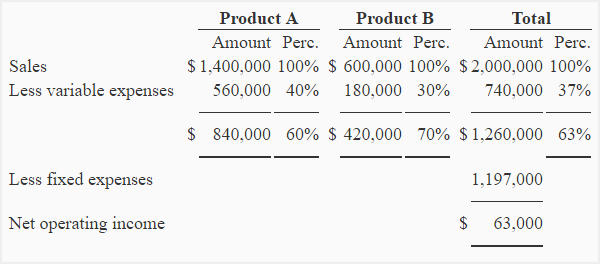

(1) Income statement:

(2) Computation of break-even point:

The PQR company sells two products. Its break-even point can be easily computed by dividing the total fixed expenses by overall contribution margin ratio (CM ratio).

Fixed expenses/Overall CM ratio

= 1,197,000/.63

= $1,900,000

Leave a comment