Exercise-1 (Target profit analysis, break-even point)

PNG Electric Company manufactures a number of electric products. Rechargeable light is one of the PNG’s products that sells for $180/unit. Total fixed expenses related to rechargeable electric light are $270,000 per month and variable expenses involved in manufacturing this product are $126 per unit. Monthly sales are 8,000 rechargeable lights.

Required:

- Compute the break-even point of PNG in both dollars and units.

- According to a research conducted by sales department, a 10% reduction in sales price will result in 25% increase in unit sale. Prepare two income statements in contribution margin format, one using the current price and one using proposed price (10% below the old sales price).

- Compute the number of rechargeable lights to be sold to earn a net operating income of $189,000 per month (use original data).

Solution:

(1). Computation of break-even point:

a. Break even point in units:

Break even point in units can be computed by using either equation method or contribution margin method. Both the methods are given below:

i. Equation method:

The equation to calculate break even point is:

SpQ = VeQ + Fe

Where;

- Sp = Sales price per unit.

- Q = Number (or quantity) of units to be manufactured and sold during the period.

- Ve = Variable expenses to manufacture and sell a single unit of product.

- Fe = Total fixed expenses for the period.

Let’s apply this equation to calculate the break even point of PNG.

SpQ = VeQ + Fe

$180Q = $126Q + 270,000

$180Q – $126Q = $270,000

$54Q = $270,000

Q = $270,000/$54

Q = 5,000 units

PNG needs to sell 5,000 units to break even.

Alternatively, we can obtain the same answer by using the contribution margin method as follows:

ii. Contribution margin method:

Break even point = Fixed expenses/Contribution margin per unit

= 270,000/54*

= 5,000 units

*$180 – $126

b. Break-even point in dollars:

Break-even point in dollars can be computed by simply multiplying the break even point in units by the sales price per unit as shown below:

Break even point in dollars = BEP in units × Sales price per unit

= 5,000 units × $180

=$900,000

(2) Income statements:

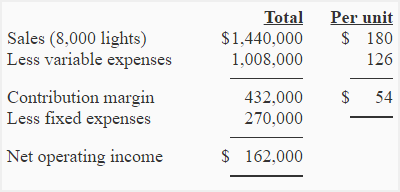

a. Income statement under current operations:

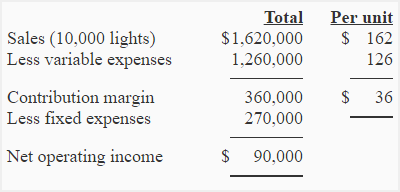

b. Income statement under proposed operations:

The proposal should not be accepted because it will reduce the contribution margin from $54 per unit to $36 per unit and net operating income from $162,000 to $90,000.

(3) Target profit analysis:

a. Equation method:

The equation to calculate the number of units to be sold to generate a target profit is:

SpQ = VeQ + Fe + Tp

Where;

Sp = Sales price per unit.

Q = Number (quantity) of units to be manufactured and sold during the period.

Ve = Variable expenses to manufacture and sell a single unit of product.

Fe = Total fixed expenses for the period.

Tp = Target profit for the period.

Let’s apply this equation to calculate the number of units to be sold to earn a profit of $189,000.

SpQ = VeQ + Fe + Tp

$180Q = $126Q + 270,000 + $189,000

$180Q – $126Q = $459,000

$54Q = $459,000

Q = $459,000/$54

Q = 8,500 units

On the basis of original data, company needs to sell 8,500 rechargeable lights to earn a profit of $189,000.

Alternatively, we can obtain the same answer by applying the contribution margin method as follows:

b. Contribution margin method:

(Fixed expenses + Target income)/Contribution margin per unit

= ($270,000+$189,000)/54

= 8,500 units

Leave a comment