Exercise 11: Cost of production report – normal loss

Learning objective:

This exercise illustrates the treatment of normal loss in the first and second departments in a process costing system.

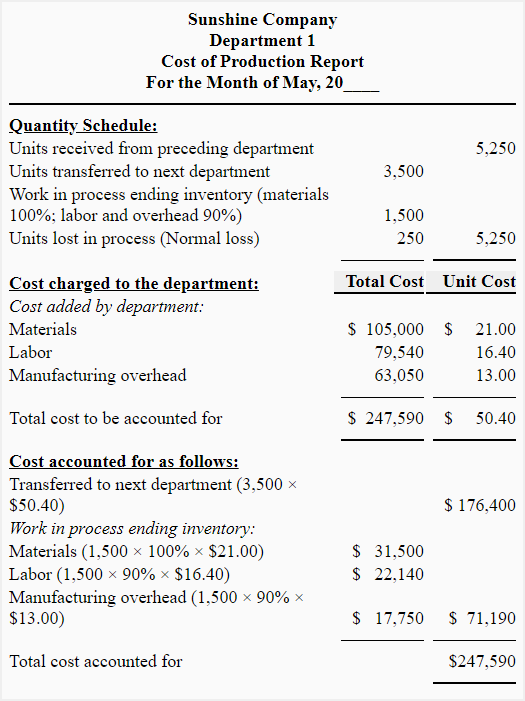

Exercise 11 (a) – normal loss in 1st department:

Sunshine Company uses a process costing system. During May, 5,250 units were put into process in the first department. 3,500 units were transferred to the next department, 250 units were lost in process, and 1,500 units were still in process at the end of the month.

For the month of May, the cost of materials used was $105,000. The labor and manufacturing overhead costs were $79,540 and $63,050, respectively.

The materials were added at the start of the production process in the first department. All units in ending inventory were 90% complete as to labor and manufacturing overhead costs. Any spoilage that occurred during the month was considered a normal loss.

Required: Prepare a cost of production report for May for the first department of Sunshine Company.

Solution

Equivalent units and unit cost

Equivalent units:

Materials: 3,500 + 1,500 = 5,000 units

labor and manufacturing overhead: 3,500 + (1,500 × 90%) = 4,850 units

Unit cost:

Materials: $105,000/5,000 units = $21.00

Labor: $79,540/4,850 units = $16.40

Manufacturing overhead: $63,050/4,850 units = $13.00

The normal loss of 250 units in the first department has been ignored because no adjustment is required for the normal loss in the first department. In the first department, the normal loss is absorbed by the remaining good units, which causes an increase in the per unit cost.

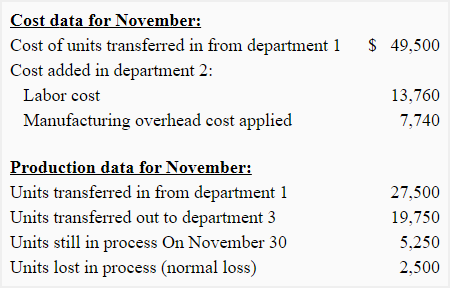

Exercise 11 (b) – normal loss in second department:

Horizon Inc. has three processing departments and uses a process costing system. For November, the cost and production data related to Department 2 is given below:

Materials are added at the beginning of the production process in Department 1. No materials are added in Department 2.

Required: Prepare a cost of production report of department 2 of Horizon Inc. for November.

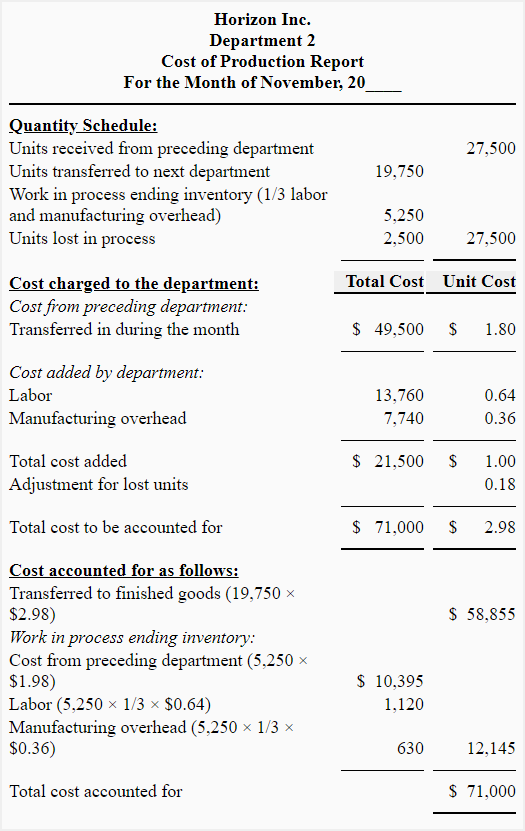

Solution

Equivalent units and unit cost:

Equivalent units:

Labor and manufacturing overhead:

5,250 units × 1/3 = 1,750 units

Unit cost:

Labor: $13,760/1,750 units = $0.64

Manufacturing overhead: $7,740/1,750 units = $0.36

Adjustment for normal loss:

= [Cost from preceding department/Good units] – Unit cost from preceding department before adjustment

= [49,500/(27,500 – 2,500)] – 1.80

= $1.98 – $1.80

= $0.18

Leave a comment