Exercise 12: Cost of production report – abnormal loss

Learning objective:

This exercise illustrates the treatment of abnormal loss while preparing a cost of production report in a process costing system.

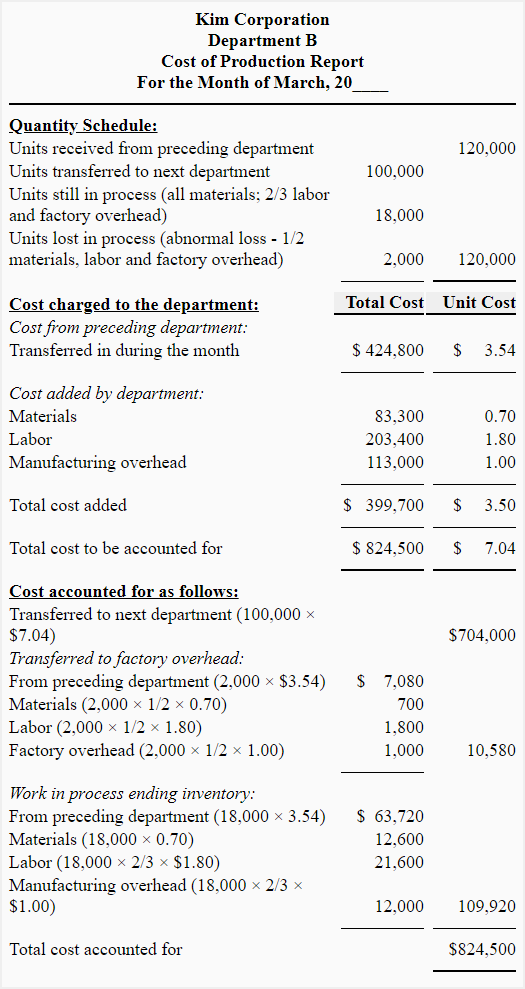

Kim Corporation has three processing departments – department A, department B, and department C. During March, department B received 120,000 units from department A at a unit cost of $3.54. Out of these 120,000 units, 100,000 were transferred to Department C, 18,000 were in process at the end of March (100% materials and 2/3 labor and manufacturing overhead), and 2,000 units were lost in process (50% complete as to all costs).

The cost added by Department B during March was as follows:

- Materials: $83,300

- Labor: $203,400

- Factory overhead: $113,000

The entire loss that occurred in Department B is considered abnormal and is to be charged to factory overhead.

Required: Using the data given above, prepare a cost of production report for department B of Kim Corporation.

Solution

Notice that the cost of 2,000 abnormally lost units has been charged to factory overhead.

Computation of equivalent units and unit cost

Equivalent units

Materials:

= 100,000 units + 18,000 units + (2,000 units) × 1/ 2

= 100,000 units + 18,000 units + 1,000 units

= 119,000 units

Labor and factory overhead:

= 100,000 units + (18,000 units) × 2/3 + (2,000 units) × 1/2

= 100,000 units + 12,000 units + 1,000 units

= 113,000 units

Unit cost

Materials:

= $83,300/119,000 units

= $0.70

Labor:

= $203,400/113,000 units

= $1.80

Factory overhead:

$113,000/113,000 units

= $1.00

Leave a comment