Exercise 10: Cost of production report of 2nd department

Learning objective:

This exercise illustrates the preparation of the cost of production report (CPR) for the second processing department.

Exercise 10 (a):

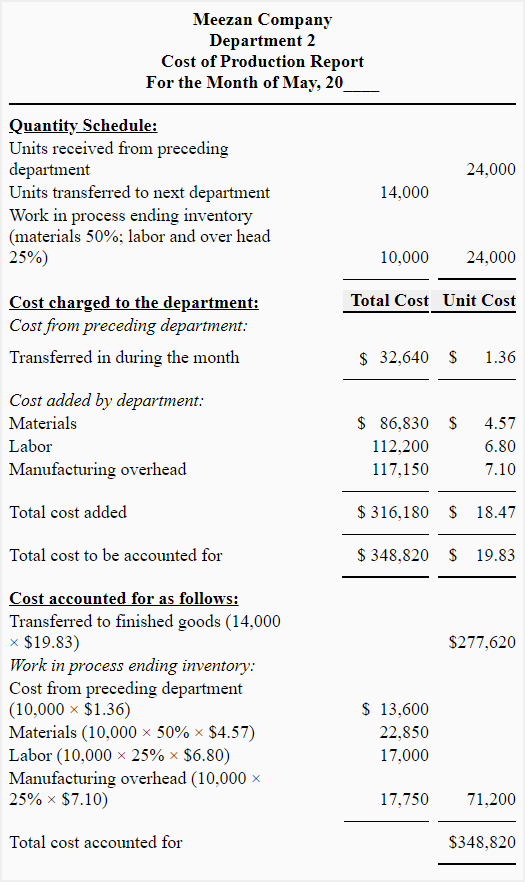

Meezan Company has three processing departments. The costs incurred in the second department during May were as follows:

Cost from first department: $32,640

Cost added by second department:

Materials: $86,830

Labor: $112,200

Manufacturing overhead: $117,150

24,000 units were received from the first department during May. 14,000 units were completed and transferred to the finished goods store room, and 10,000 units were still in process at the end of May. The units in work-in-process ending inventory were 50% complete with respect to materials and 25% complete with respect to labor and manufacturing overhead costs.

Required: Using the above data, prepare a cost of production report for May for the second department of Meezan Company.

Solution

Equivalent units and unit cost:

Equivalent units:

Materials: 14,000 units + (10,000 units × 50%) = 19,000 units

Labor and overhead: 14,000 units + (10,000 units × 25%) = 16,500 units

Cost per equivalent unit:

Material: $86,830/19,000 units = $4.57

Labor: $112,200/16,500 units = $6.80

Manufacturing overhead: $117,150/16,500 units = $7.10

Exercise 10 (b):

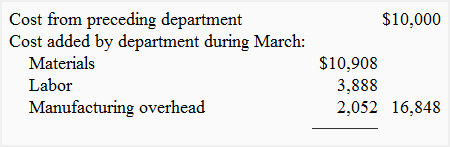

Xcell Health Care Company uses a process costing system. The costs incurred in Department 2 during the month of March are given below:

The quantity schedule for Department 2 has provided the following information:

- Units received from department 1: 2,500 units

- Units transferred to department 3: 2,000 units

- Units still in process on March 31: 500 units

The stages of completion of units in process with respect to the cost incurred are given below:

- 50% of the units were 40% complete

- 20% of the units were 30% complete

- 30% of the units were 20% complete

There were no work-in-process inventories on March 1. There was no normal or abnormal spoilage in Department 2 during March.

Required: Prepare a cost of production report for Department 2 of Xcell Health Care Company.

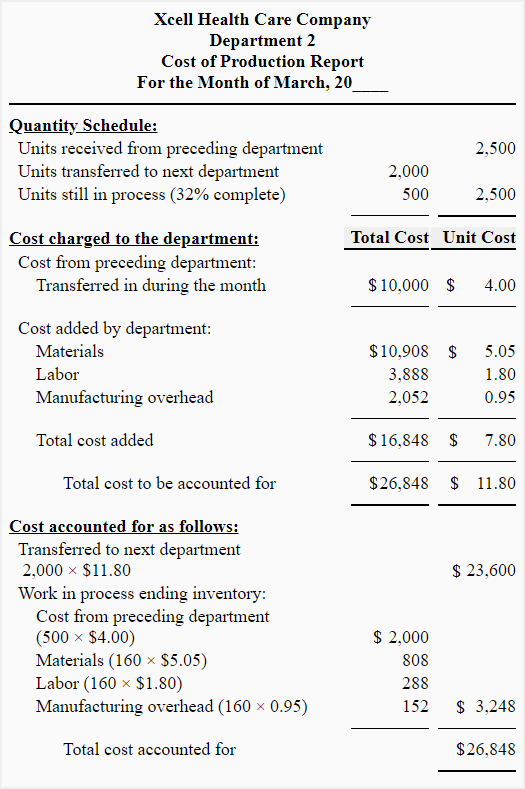

Solution

Equivalent units and unit cost:

Equivalent units:

Materials, labor and manufacturing overhead:

= 2,000 + 500 × 32%*

= 2,000 + 160

= 2,160 units

*Total units in process are 500. Out of these 500 units, 50% are 40% complete, 20% are 30% complete, and the remaining 30% are 20% complete.

= [(50% of 500) × 40%] + [(20% of 500) × 30%] + [(30% of 500) × 20%]

= [250 × 40%] + [100 × 30%] + [150 × 20%]

= 100 + 30 + 30

= 160 units

160 units are 32% of the total 500 units in work-in-process ending inventory, as computed below:

= [(160/500) × 100]

= 32%

Cost per equivalent unit cost:

Material: $10,908/2,160 units = $5.05

Labor: $3,888/2,160 units = $1.80

Manufacturing overhead: $2,052/2,160 units = $0.95

Leave a comment