Equivalent units of production – weighted average method

Definition and concept of equivalent units

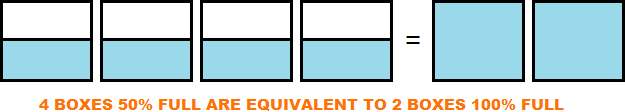

In a process costing system, the term equivalent units may be defined as the partially complete units expressed in terms of the equivalent number of fully complete units. The processing departments often have some partially complete units at the end of a given period, known as work-in-process ending inventory. Since these partially complete units cannot be considered fully complete units for determining the department’s total output and per unit cost, they are mathematically converted into their equivalent number of fully complete units. Consider the following exhibition to understand the concept of equivalent units:

In a process costing system, the equivalent number of units is obtained by multiplying the number of partially complete units in work-in-process inventory by their percentage of completion as follows:

Equivalent units = Partially complete units × Percentage of completion

Suppose, for example, that Department X has completed and transferred out 5,000 units during the month. In addition, it also has 800 units in work-in-process inventory that are 50% complete. Since these 800 units in inventory are 50% complete, they are equivalent to 400 fully complete units, as computed below:

Equivalent units = 800 units × 50%

= 400 units

In order to compute the total equivalent production of Department X, the equivalent units in work-in-process ending inventory would be added to the units completed and transferred out during the month. Therefore, the department’s total equivalent production for the month is 5,400 units – 5,000 units completed during the month plus 400 equivalent units in work-in-process ending inventory.

Equivalent units of production under weighted average method

There are two methods for computing the equivalent units of production for a processing department – the weighted average method and the FIFO method. On this page, we have explained and exemplified the weighted average method. After learning this method, navigate to the next page to read about the FIFO method.

The weighted average method blends together the units and cost of the current period with the units and cost of the previous period. Under this method, the equivalent units of production in a department are equal to the units completed during the period plus the equivalent units in work-in-process inventory at the end of the period.

Formula

Under the weighted average method, the equivalent units of production or total output of a department are computed by using the following formula:

Equivalent units of production = Units completed + (Units still in process × Percentage of completion)

Let’s take an example to further clarify the concept of equivalent production under the weighted average method.

Example

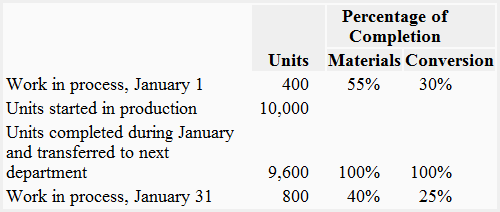

Roberts Company provides you with the following data for Department X:

Required: Using the data from Department X given above, compute the equivalent units of production for the month of January under the weighted average method.

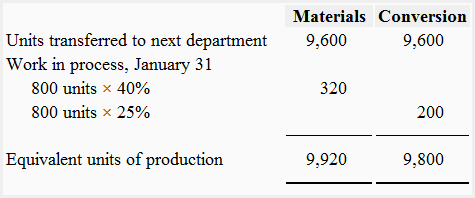

Solution

Explanation to the solution

- Units transferred to the next department: The units transferred to the next department or finished goods store room are always assumed to be 100% complete as to materials and conversion costs. We don’t need to compute equivalent units for 9,600 units transferred to the next department because they would not have been transferred out unless they were fully processed.

- Work-in-process, January 31: The 800 units in work in process ending inventory have been 40% completed for materials and 25% completed for conversion cost during the month. In order to obtain the equivalent units for materials and conversion cost, these partially complete units have been multiplied by their percentage of completion, which is 40% for materials and 25% for conversion cost.

- Work-in-process, January 1: The 400 units in work-in-process beginning inventory have been ignored while computing the equivalent units of production. The reason is that the weighted average method blends together the costs and units of the previous period with the costs and units of the current period. It is not concerned with the fact that some processing work was done in the previous period.

Click on the next link below to read the FIFO method

Leave a comment