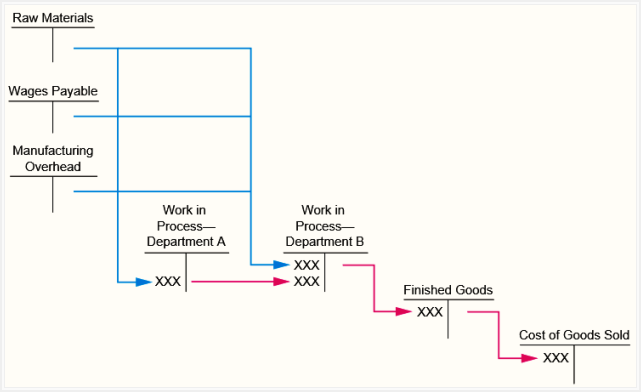

The cost flow and journal entries in process costing system

The accumulation of costs in a process costing system is simpler than in a job order costing system. Unlike the job order costing system, in which manufacturing costs (materials, labor, and manufacturing overhead) are traced to a large number of individual jobs, the process costing system traces costs to only a few processing departments.

In the process costing system, a separate work-in-process account is maintained for each department. The production cost flows in parallel with the flow of physical units. When the processing work in a particular department is completed, the units, along with their cost, are transferred to the next department for further processing.

The costs and journal entries in process costing system

The materials, labor, and manufacturing overhead costs in a process costing system are incurred and recorded as follows:

1. Materials cost

In the process costing system, a materials requisition form is used to draw materials from the storeroom. When materials are used in a particular department, the following journal entry is made:

Work in process – Department name [Dr.]

Raw materials [Cr.]

In the debit part of the above journal entry, the words “department name” refer to the name of the particular department in which materials (or another cost like labor and manufacturing overhead) are incurred. For example, if materials are used in Department A, the debit part of the journal entry would consist of “Work in process – Department A”, and the journal entry would look like the following:

Work in process – Department A [Dr.]

Raw materials [Cr.]

Similarly, if materials are used in Department B, the debit part of the entry would consist of “Work in process – Department B”, and the journal entry would look like the following:

Work in process – Department B [Dr.]

Raw materials [Cr.]

In many industries, materials are added only in the first processing department. In subsequent departments, only the labor and manufacturing overhead costs are added. However, it is not uncommon to find manufacturing processes where materials are added in the first as well as in one or more subsequent departments.

2. Labor cost

The labor costs in a process costing system are traced to processing departments rather than individual jobs. The journal entry to record labor costs attributable to a particular processing department is given below:

Work in process – Department name [Dr.]

Salaries and wages payable [Cr.]

3. Manufacturing overhead cost

Like job order costing, the process costing system usually uses a predetermined overhead rate to apply manufacturing overhead costs. A separate predetermined overhead rate is computed for each processing department and applied to production as the units move through the department. The journal entry to record manufacturing overhead costs in a process costing system looks like the following:

Work in process – Department name [Dr.]

Manufacturing overhead [Cr.]

Transfer of costs and completion of cost flow

1. When partially completed units are transferred to the next department

Once the processing work in a particular department has been completed, the units and their costs are transferred to the next department, where partially completed units are further processed. For example, if a company has only two processing departments, department A and department B, the following journal entry would be made to transfer the costs of partially completed units from department A to department B:

Work in process – Department B [Dr.]

Work in process – Department A [Cr.]

2. When completed units are transferred to the finished goods storeroom

The above journal entry transfers the cost of partially completed units from department A to department B. After completing the processing work in department B, the partially completed units would be converted into finished goods, and the total cost of completed units would be transferred from department B to the “finished goods inventory account”. The following journal entry would be made for this purpose:

Finished goods [Dr.]

Work in process – Department B [Cr.]

3. When goods are sold to a customer

When goods are sold to a customer, the cost of units sold would be transferred from the “finished goods inventory account” to the “cost of goods sold account”. The following journal entry would be made for this purpose:

Cost of goods sold [Dr.]

Finished goods [Cr.]

Important points to remember

Students should remember the following important points regarding the flow of costs and units in a process costing system:

- Materials, labor, and manufacturing overhead costs can be added to production in any processing department, not only in the first department.

- A separate work-in-process account is maintained for each processing department.

- Once the processing work in a department is completed, the production cost is transferred to the work-in-process account of the next department.

- In the final department, the uncompleted units are converted into completed units or finished goods, and the total production cost accumulated in this department is transferred to the “finished goods inventory account”.

- When a customer’s order is fulfilled and the goods are shipped to him, the cost of units sold is transferred from the “finished goods inventory account” to the “cost of goods sold account”.

The whole discussion about the flow of costs and physical units in a process costing system can be summarized by the following T-accounts model:

Leave a comment