Equivalent units of production – FIFO method

This article explains the computation of equivalent units of production under the FIFO method. The concept of equivalent units has been explained in the previous article of this chapter – equivalent units of production under the weighted average method. If you have come to this article directly, we suggest you first read the previous article to grasp the concept of equivalent units and then come back to this article to continue. Go to the previous article.

Equivalent units of production under FIFO method

The computation of equivalent units under the FIFO method is a little bit more complex than under the weighted average method. The weighted average method blends the cost and work of the current period with the cost and work of the previous period. The FIFO method, on the other hand, clearly separates the work done in the current period from the work done in the prior period. The equivalent units of production under the FIFO method include work done in the current period only.

Before we present the formula used in the FIFO method and exemplify the procedure of computing equivalent units of production, you need to know the following two important characteristics of the FIFO method of process costing:

- The FIFO method divides the units completed during the period into two parts – those that belong to the beginning inventory and those that belong to the production started during the current period.

- This method gives full consideration to the work done on the units in both work-in-process beginning and work-in-process ending inventory during the current period. Under this method, the unfinished units in the beginning as well as the ending inventory are separately converted into their equivalent number of fully complete units. The equivalent units from the beginning inventory represent the work done to complete the units that remained incomplete at the end of the previous period. The equivalent units from the ending inventory represent the work done to bring those units to a stage of partial completion. These partially completed units at the end of the current period become the beginning work-in-process inventory of the next period.

Formula

The formula to compute equivalent units of production under the FIFO method is given below:

Equivalent units under FIFO method =

Percentage of work done on beginning inventory in current period + Units started and completed during current period + Percentage of work done on ending inventory in current period

See the application of this formula in the following example:

Example

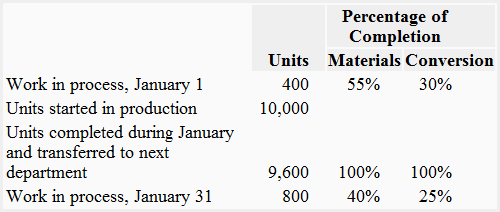

Roberts Company provides you with the following data for Department X:

Required: Compute the equivalent units of production of Department X for the month of January using the FIFO method.

Solution

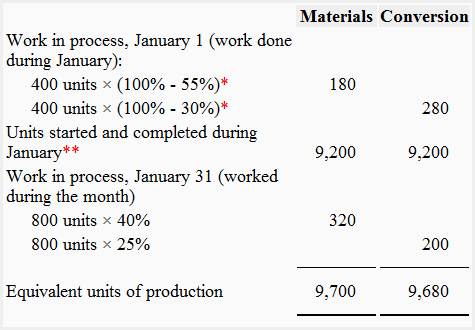

*Percentage of work done during January:

**Units started and completed during January:

Units started during January – Units in ending inventory

= 10,000 units – 800 units

= 9,200 units

Alternatively, we can compute this figure as follows:

Units completed and transferred out during January – Units in beginning inventory

= 9,600 – 400 units

= 9,200 units

Explanation to the solution

In the above solution, notice that the equivalent units of production are the sum of the percentage of work done on the units in beginning inventory during January, units started and completed during January, and the percentage of work done on the units in ending inventory during January.

- Beginning inventory – work done during January: Notice that only 45% (= 100% – 55%) units for materials and 70% (= 100% – 30%) units for conversion cost have been considered the equivalent units. The reason is that 55% completion for materials and 30% completion for conversion had already been done in the previous period. As described earlier in this article, the FIFO method accounts for the work done in the prior period and the work done in the current period separately. The equivalent units of production under FIFO consist of work done during the current period only.

- Units started and completed during January: These are the units on which 100% of the work with respect to materials and conversion costs has been done during January. All the units that are started and completed during the current period must be included in the computation of equivalent units of production. In our example, the number of units started and completed during the current period is 9,200.

- Ending inventory – work done during January: The computation of equivalent units in work-in-process ending inventory under FIFO is similar to the weighted average method. Under both methods, only the percentage of completion is included in the equivalent units of production. The given percentage of completion represents the work done on units in ending inventory during the current period. In the above example, this percentage is 40% for materials and 25% for conversion costs.

Leave a comment