Current ratio

Current ratio (also known as working capital ratio) is a popular tool to evaluate short-term solvency position of a business. Short-term solvency refers to the ability of a business to pay its short-term obligations when they become due. Short term obligations (also known as current liabilities) are the liabilities payable within a short period of time, usually one year.

A higher current ratio indicates strong solvency position of the entity in question and is, therefore, considered better.

Formula

Current ratio is computed by dividing total current assets by total current liabilities of the business. This relationship can be expressed in the form of following formula or equation:

Above formula comprises of two components i.e., current assets and current liabilities. Both of these components should be available from the entity’s balance sheet. Some examples of current assets and current liabilities are listed below:

Some common examples of current assets are given below:

- Cash

- Marketable securities

- Accounts receivables/debtors

- Inventories/stock

- Bills receivable

- Short-term totes receivable

- Prepaid expenses

Some common examples of current liabilities are given below:

- Accounts payable/creditors

- Bills payable

- Short-term notes payable

- Short term bonds payable

- Interest payable

- Unearned revenues

- current portion of long term debt

Example

On December 31, 2016, the balance sheet of Marshal company shows the total current assets of $1,100,000 and the total current liabilities of $400,000. Your are required to compute current ratio of the company.

Solution

Current ratio = Current assets/Current liabilities

= $1,100,000/$400,000

= 2.75 times

The current ratio is 2.75 which means the company’s currents assets are 2.75 times more than its current liabilities.

Significance and interpretation

Current ratio is a useful test of the short-term-debt paying ability of any business. A ratio of 2:1 or higher is considered satisfactory for most of the companies but analyst should be very careful while interpreting it. Simply computing the ratio does not disclose the true liquidity of the business because a high current ratio may not always be a green signal. It requires a deep analysis of the nature of individual current assets and current liabilities. A company with high current ratio may not always be able to pay its current liabilities as they become due if a large portion of its current assets consists of slow moving or obsolete inventories. On the other hand, a company with low current ratio may be able to pay its current obligations as they become due if a large portion of its current assets consists of highly liquid assets i.e., cash, bank balance, marketable securities and fast moving inventories. Consider the following example to understand how the composition and nature of individual current assets can differentiate the liquidity position of two companies having same current ratio figure.

Liquidity comparison of two or more companies with same current ratio

We may find situations where two or more companies have the same current ratio figures but their real liquidity position is far different from each other. It happens because of the quality and nature of individual items that make up the total current assets of the companies. Consider the following example to understand this point in more detail:

Example

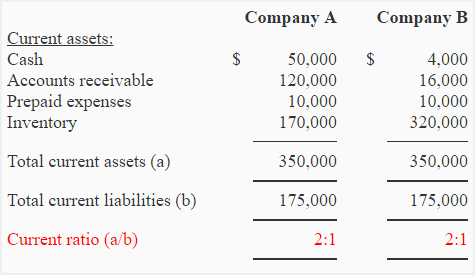

The following data has been extracted from the financial statements of two companies – company A and company B.

Both company A and company B have the same current ratio (2:1). Do both the companies have equal ability to pay its short-term obligations? The answer to this question is a “no” because company B is likely to have difficulties in paying its short-term obligations. Most of its current assets consist of inventory which might not be quickly convertible into cash. The company A, on the other hand, is likely to pay its current obligations as and when they become due because a large portion of its current assets consists of cash and receivables. Accounts receivable are generally considered more liquid assets in nature and thereby have a better chance to be quickly converted into cash than inventories.

The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets.

Limitations of current ratio

Current ratio suffers from a number of considerable limitations and, therefore, can’t be applied as the sole index of liquidity. Some major limitations are given below:

1. Different ratio in different parts of the year:

The volume and frequency of trading activities have high impact on the entities’ working capital position and hence on their current ratio number. Many entities have varying trading activities throughout the year due to the nature of industry they belong. The current ratio of such entities significantly alters as the volume and frequency of their trade move up and down. In short, these entities exhibit different current ratio number in different parts of the year which puts both usability and reliability of the ratio in question.

2. Issues in inter-firm comparison:

Financial ratios are often made part of inter-firm comparison – a comparison of operating performance and financial status of two or more similar commercial entities working in the same industry, primarily conducted to learn and achieve a better business performance. To compare the current ratio of two companies, it is necessary that both of them use the same inventory valuation method. For example, comparing current ratio of two companies would be like comparing apples with oranges if one uses FIFO while other uses LIFO cost flow assumption for costing/valuing their inventories. The analyst would, therefore, not be able to compare the ratio of two companies even in the same industry.

3. Just a test of quantity, not quality:

Current ratio is a number which simply tells us the quantity of current assets a business holds in relation to the quantity of current liabilities it is obliged to pay in near future. Since it reveals nothing in respect of the assets’ quality, it is often regarded as crued ratio. For example, an entity with a favorable current ratio may still be at liquidity risk if it currently lacks on cash to settle its short-term liabilities and a bigger portion of its total current assests is composed of work in process inventories and slow moving stocks which generally require a longer period of time to bring cash in business.

4. Window dressing and manipulation:

Current ratio can be easily manipulated by equal increase or equal decrease in current assets and current liabilities numbers. For example, if current assets of a company are $10,000 and current liabilities are $5,000, the current ratio would be 2 : 1 as computed below:

$10,000 : $5,000 = 2 : 1

Now If both current assets and current liabilities are reduced by $1,000, the ratio would be increased to 2.25 : 1 as computed below:

$9,000 : $4,000 = 2.25 : 1

Similarly if we increase both the elements by $1,000, the ratio would be decreased to 1.83 : 1 as computed below:

$11,000 : $6,000 = 1.83 : 1

However in order to minimize the impact of above mentioned limitations and to conduct a meaningful and reliable liquidity analysis of a business, the current ratio can be used in conjunction with many other ratios like inventory turnover ratio, receivables turnover ratio, average collection period, current cash debt coverage ratio, and quick ratio etc. These ratios are helpful in testing the quality and liquidity of a number of individual current assets and together with current ratio can provide much better insights into the company’s short-term financial solvency.

Computating current assets or current liabilities when the ratio number is given

Students may come across examination questions or home work problems in which the examiner or tutor provideds a current ratio number along with some additional information pertaining to a business entity and asks them to work out either total current assets or total current liabilities figure. For example, he may provide current ratio and one of the total current assets or total current liabilities figure and ask the students to calculate the other one. There is no difficulty involved in computations like this, because we can work out either of the two figures just by rearranging the components of formula given above. Consider the two examples given below:

Example 1

T & D company’s current ratio is 2.5 for the most recent period. If total current assets of the company are $7,500,000, what are total current liabilities?

Solution

Current ratio = Current assets/Current liabilities

or

Current liabilities = Current assets/Current ratio

= $7,500,000/2.5

= $3,000,000

Example 2

If Marbel Inc’s current ratio is 1.4 and total current liabilities are $8,000,000, what are its total current assets?

Solution

Current ratio = Current assets/Current liabilities

or

Current assets = Current liabilities × Current ratio

= $8,000,000 × 1.4

= $11,200,000

Need to help for doing my homework about accounting