Interest payable

Content:

- Definition and explanation

- Journal entry to accrue interest payable

- Interest payable on balance sheet

- Example

Definition and explanation

Interest payable is an entity’s debt or lease related interest expense which has not been paid to the lender or lessor as on balance sheet date. The term is applicable to the unpaid interest expense up to the balance sheet date only; any amount of interest that relates to the period after balance sheet is not made part of the interest payable. In general ledger, a liability account named as “interest payable account” is maintained and used to accumulate the amount of interest expense that has been incurred but not paid during the period.

The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective. For example, a higher than normal amount of unpaid interest signifies that the entity is defaulting on its debt liabilities. A higher interest liability may also impair the entity’s liquidity position in the eyes of its stakeholders.

Journal entry to accrue interest payable

The unpaid interest is accrued by debiting interest expense account and crediting interest payable account. The adjusting entry for this looks like the following:

Interest expense [Debit]

Interest Payable [Credit]

The above accrual entry creates an expense and a liability. The liability goes to the balance sheet and the associated expense is charged to the income statement. Depending on the entity’s accounting procedure, this adjusting entry may be passed at the end of each month, each quarter, or only once at the end of the relevant accounting period.

When interest payable liability is extinguished by paying cash or through a checking account, it is eliminated from books by debiting interest payable account and crediting cash or bank account. The journal entry for this looks like the following:

Interest payable [Debit]

Cash/Bank [Credit]

Interest payable on balance sheet

The interest payable account is classified as liability account and the balance shown by it up to the balance sheet date is usually stated as a line item under current liabilities section.

The current period’s unpaid interest expense that contributes to the interest payable liability is reported in income statement. Interest is not reported under operating expenses section of income statement because it is a charge for borrowed funds (i.e., a financial expense), not an operating expense. It is usually presented in “non-operating or other items section” which typically comes below the operating income.

Consider the following example to sum up the whole discussion given above.

Example

Maria Textile Company needs $500,000 cash on immediate basis. To meet this need, it issues a 6 month 15% note payable to a lender on November 1, 2020 and collects $500,000 cash from him on the same day. Maria will repay the principal amount of debt plus interest @ 15% on April 30, 2021, on which the note payable will come due.

Required:

- Prepare adjusting entries to accrue the interest expense at the end of both November and December.

- Compute the total amount of interest payable on December 31, 2020.

- How would the Maria Textile Company show the original debt of $500,000 and the interest payable thereon in its balance sheet as on:

(i). December 31, 2020?

(ii). March 31, 2021?

Solution

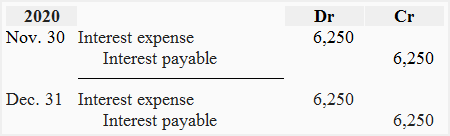

1. Adjusting entries to accrue the interest expense at the end of November and December 2020:

Interest for one month: $500,000 × 15% × 1/12 = $6,250

2. Total amount of interest payable on December 31, 2020:

Interest for November + Interest for December

= $6,250 + $6,250

= $12,500

Alternatively, the interest payable on December 31, 2020 can be computed as follows:

$500,000 × 15% × 2/12

= $12,500

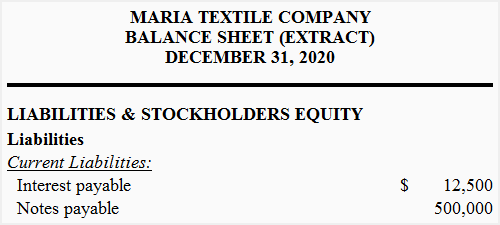

3. Presentation of note payable and interest payable on balance sheet:

(i). On December 31, 2020:

Maria Company would show the note payable and interest thereon for two months in current liabilities section of its balance sheet as follows:

The interest expense of $12,500 incurred during 2020 must be charged to the income statement for the year 2020.

The interest for the remaining four months (i.e., $25,000 = $500,000 × 15% × 4/12) has not yet been incurred by the company. Therefore, it can’t be accrued and reported as liability in the balance sheet prepared on December 31, 2020. The liability will only come into existence when the company will use the debt and incur interest expense in the next period. The company can, however, disclose the appropriate information regarding this future liability in notes to its financial statements.

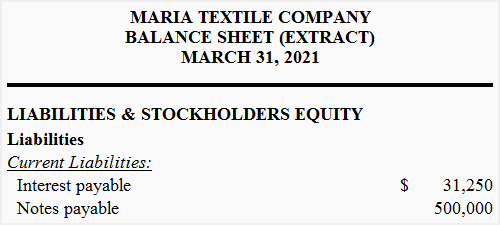

(ii). On March 31, 2021:

At the end of first quarter of 2021 (i.e., on March 31, 2021), the interest payable account will show a credit balance of $31,250 as computed below:

$500,000 × 15% × 5/12

= $31,250

On March 31, 2021, both note payable and interest payable will be shown on balance sheet as follows:

Leave a comment