Capital budgeting process

Companies must possess enough capital or long-term assets to run their operations successfully. Smart companies continuously invest in new long-term productive and cost efficient assets, which help them grow, expand and be competitive in their industry. Running operations with obsolete and less efficient assets has many significant competitive disadvantages, including increased costs, limited production and customers dissatisfaction etc.

Definition and explanation

The capital budgeting process is a six-step process that companies follow to determine the potential benefit of a capital or long-term asset and finally decide whether or not to invest in that asset. This is mainly done through the use of one or more capital budgeting techniques that we will talk about later in this article.

In the capital budgeting process, managers carefully evaluate different investment opportunities that are identified and proposed at various levels of the organization and select the ones that look most viable and promise the largest financial benefit in the future.

A capital budgeting process must be carried out with extreme care and delicacy because the assets that pass through this process largely impact the company’s future performance and growth.

Steps in capital budgeting process

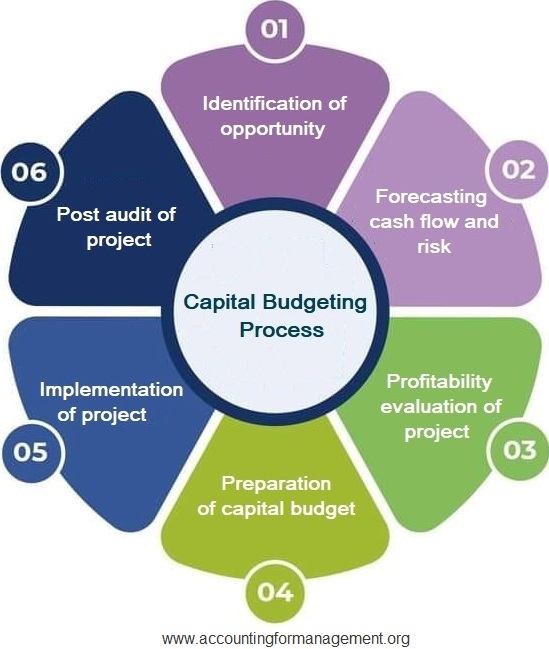

A capital budgeting process comprises of the following six steps:

- Identification of opportunity

- Forecasting cash flows and estimating project risk

- Profitability evaluation of project

- Preparation of capital budget

- Implementation of project

- Post audit of project

Let’s briefly elaborate these sequential steps in rest of this article.

1. Identification of opportunity

The capital budgeting process starts with the identification of an investment opportunity which may come from any level of management serving within the organization. If an opportunity is identified and proposed by a lower-level manager, the process is named as bottom-up capital budgeting. A production manager, for example, is in a better position to understand the benefits of replacing an existing machine with its upgraded version. Similarly, an attendance manager can better explain the convenience of having a computerized system to keep record of employees’ attendance.

If, on the other hand, a proposal is identified by a top level manager, it is named as top-bottom capital budgeting. For example, acquiring a new business to enter a new market or starting a different product or service is a strategic level investment decision which requires initiative from senior management.

2. Forecasting cash flows and project risk

Once an opportunity has been identified and proposed, the company needs to evaluate its profitability by estimating its future cash flows and any potential risk involved. The cash flows of a project mainly depend on company’s own operational capabilities as well as a broad range of macroeconomic factors including inflation rate, interest rate, employment level, fiscal policy, gross domestic product (GDP), national income and worldwide trading activities. Since all these factors may impact a project’s ability to generate cash in future, companies must gather updates on them as their capital budgeting process moves forward.

Project risk means one or multiple uncertain events that, if occur, can impact the basic objectives of the project. Companies must incorporate project risk in their capital budgeting process to make sure that their cash flow forecasting is not overly optimistic. For this purpose, they can apply various risk analysis techniques like sensitivity analysis, scenario analysis, risk adjusted discount rate and certainty equivalent cash flow etc.

3. Profitability evaluation of project

There are several capital budgeting techniques that companies can use to evaluate a proposed project. Six popular ones are listed below:

- Net present value (NPV) method

- Profitability index (PI) method

- Internal rate of return (IRR) method

- Simple payback method

- Discounted payback method

- Accounting rate of return (ARR)

The first five techniques are based on cash flows whereas the last one uses incremental accounting income or loss (i.e., the income or loss contributed by the project) rather than cash flows.

For each specific technique, companies have a predetermined set of criteria against which they compare the project’s expected results to make their acceptance or rejection decision. For example, if a company applies NPV technique, It must have a predefined net present value (NPV) that the project must meet or exceed to be an acceptable investment. Similarly, if a company uses payback method, it must have a predetermined period within which the project must recover all of its initial investment.

Since companies have diverse business requirements, they can’t apply on a single capital budgeting technique to evaluate all projects. Which technique makes the most sense for a particular situation depends on the nature of the project as well as financial objectives of the company. In practice, projects are mostly evaluated on the basis of multiple techniques before they are finally accepted for investment. The NPV, PI and IRR work well and are often relied upon because they are all based on time value of money.

The projects that pass profitability test in this step are marked as accepted and the ones that fail are left as rejected. Only accepted projects qualify for the next step – preparation of capital budget.

4. Preparation of capital budget

After identifying all feasible projects in step 3, companies rank them on the basis of their profitability and available funds. This ranking is done through a process known as capital rationing process, also referred to as project ranking process. Once the rationing process is completed, projects are approved to be listed in the company’s annual capital budget. A company’s annual capital budget contains all the projects that can be fully funded during the year.

Individual managers serving at various levels of organization can approve only those projects that fall within their authorized limit of investment. Generally, the higher the level of a manager, the larger the size of project he can approve. For example, a production manager may be authorized to decide about a project that can be started with an initial investment of $100K only. Similarly, a project requiring an initial outlay of $1 million or higher may call for approval from chief executive officer (CEO).

5. Implementation of project

After a project has been approved, the initial capital is released for its implementation and project specific responsibilities are assigned to the relevant managers, who then take initial steps for a smooth progress of the project.

If more than one projects have been approved and listed in the company’s capital budget, the implementation follows a preference ranking, as discussed in step 4 above.

6. Post audit of project

After a project has been implemented, a post audit is conducted to check how close the actual results are to the estimated numbers. The post audit is a key step in capital budgeting process. It helps minimize the chances of downplaying the costs or artificially inflating the profitability of a project, and thereby keep managers fair and honest in their investment proposals. It also reveals opportunity to invest more in successful projects and to cut losses on stranded ones.

A company should use the same capital budgeting technique in its post audit analysis as it used at the time of approval of the project. For example, if management uses NPV method to approve a particular project, it should use the same NPV method while performing a post audit of that project. However, the numbers used in post audit should come from the actual or observed data rather than the estimated data. This allows managers to perform a side-by-side comparison of actual and estimated numbers and see how successfully their project has been implemented and is moving forward.

Thank you! This work helped me a lot