Stock warrants

- Definition and explanation

- How do stock warrants work?

- Journal entries for warrants issued with other securities

- Journal entries for warrants issued as stock rights

Definition and explanation

Stock warrants are corporate issued certificates that entitle their holders to buy a specified number of common shares of the issuing corporation at a stated price and within a certain predetermined period. This is similar to the conversion feature of a convertible debt. Stock warrants, if converted, become the shares of common stock and reduce the earnings per share (EPS) of issuing entity, similar to other dilutive securities. The major difference between a stock warrant and other convertible securities is that the holder of a warrant needs to pay a certain pre-stated amount of money to exercise the conversion right.

Companies generally issue stock warrants under one or more of the following three situations:

- At the time of issuing debt or equity securities, companies sometime add warrants as equity kicker to make the securities more attractive for investors.

- The companies sometime issue warrants to stockholders to evident their pre-emptive right of buying the shares first in case they sell additional common stock in future.

- Companies also issue warrants to their employees and executives as a form of compensation. Such issuance is often referred to as stock options.

How do stock warrants work?

As stated earlier, stock warrants entitle investors to buy common shares at a fixed price in future. Let’s take an example to explain how stock warrants work.

Suppose, for example, Nelson Company sells one share of common stock and one detachable warrant as a unit for $45.50. The detachable warrant, as the name implies, can be separated and traded as an independent security. (We will talk more about detachable and nondetachable warrants later in this article).

A Nelson warrant is exercisable at $48.50 per common share and is valid for a period of ten years. The price of one common share the day before the sale of unit was $39.76. The difference of $5.74 (= $45.50 – $39.76) can, therefore, be deemed as the price allocable to detachable warrant.

Since the price of Nelson’s common share (i.e., $39.76) is much below the exercise price (i.e., $48.50), It would not be profitable to exercise the right to purchase the stock at present. However, suppose, the share price rises to $60 after a couple of months, the investors gain $5.76 (= $60 – $48.50 – $5.74) on an investment of $5.74, which is a 100% return. If, on the other hand, the price of Nelson’s stock never increases, the investors lose the additional money (i.e., $5.74 per warrant) they paid to buy these warrants. From above example, it is apparent that purchasing stock warrants can be an “all or nothing” idea.

Journal entries for warrants issued with other securities

Stock warrants sold together with other securities, like bonds and shares, generally remain effective for a period of five to ten years. Occasionally, companies issue warrants without an expiry date, known as perpetual warrants. These warrants can be detachable or nondetachable. Let’s explain how both the types are accounted for in the books of a company.

(1) When warrants are detachable

When a company sells detachable stock warrants with another security, like bonds or preferred stock, it should allocate the proceeds between two securities because both the securities are separable and can be sold or traded as independent financial instruments. For this purpose, companies normally use one of the two allocation methods – (i) proportional method and (ii) incremental method. Let’s briefly discuss and exemplify both the methods.

(i) Proportional method of allocation

The proportional method allocates the transaction proceeds between two or more securities on the basis of their market values – the values at which they are traded soon after their issuance. This method works when a company sells different types of securities in lump-sum and reliably knows the fair market value of each security involved.

Example

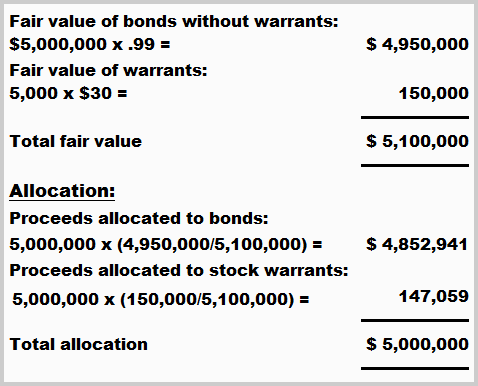

The Western Company sells 5,000 bonds ($1,000 par) with detachable stock warrants for a total price of $5,000,000. Soon after their issuance, the bonds are selling at 99 without warrants and the market price of a warrant is $30. The holders can exercise one Western detachable warrant to buy one share of its $5 par value common stock at $25.

Using the proportional method, the company can allocate its transaction proceeds between bonds and stock warrants as follows:

In this case, the proceeds allocated to bonds ($4,852,941) are less than their par value ($5,000,000). Therefore, the company would record a discount of $147,059 (= $5,000,000 – $4,852,941) in the debit part of the bonds entry.

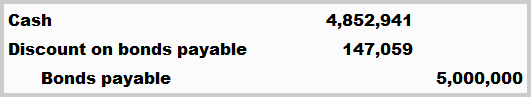

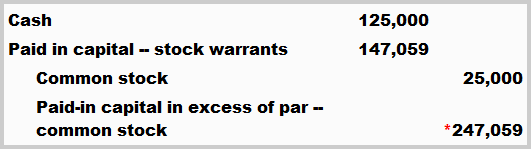

The journal entries for the issuance of two securities are given below:

(i). For the sale of bonds payable:

(ii). For the sale of warrants:

Assuming the holders exercise all 5,000 warrants, Western would record the conversion as follows:

(ii). Incremental method of allocation

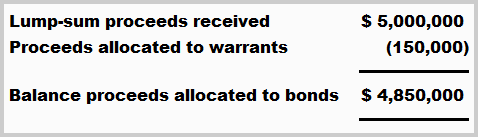

The incremental method is used in situations where the company can’t reliably determine the fair value of one of the two or more financial instruments sold together. The company subtracts the known fair market value or values from the lump-sum proceeds received and allocates the remaining amount to the security with unknown fair market value.

Example

Refer to the Western Company’s example given above under proportional method and assume that the fair value of warrants is $150,000 but the company can’t determine a fair market value for bonds without warrants. In this situation, the company can allocate transaction proceeds to bonds payable using incremental method as follows:

(2). When warrants are nondetachable

A non-detachable warrant, as the name implies, cannot be separated from the instrument it is sold with. These warrants, therefore, can’t be sold and traded as separate financial instruments. For example, Investor A buys a bond from XYZ Inc. The bond has a nondetachable warrant attached to it. If investor A sells the bond to investor B, the warrant attached with the bond automatically gets transferred to investor B.

When a company sells nondetachable stock warrants with a debt security (like bonds etc.), it does not need to allocate the proceeds between debt and warrants. The entire proceeds received in respect of such warrants are recorded as debt, just like in case of convertible bonds.

Journal entries for warrants issued as stock rights

When a company’s management decides to sell additional shares of common stock, the existing stockholders usually have a right to buy the new shares in proportion to the number of shares they already hold. This pre-emptive privilege of buying additional stock is known as stock right. It protects existing stockholders against the dilution of their voting right. Additionally, it generally allows them to acquire shares somewhat below their current market price, which gives the rights a value in themselves.

Unlike the stock warrants attached with bonds or other securities, the warrants issued as stock right are generally effective for a short duration. A warrant representing the stock right contains information like the number of new shares the holder is eligible to buy and the price at which those shares can be purchased. The stock right is ordinarily given in the ratio of 1 : 1, that is, each share owned gives the holder one stock right. Until it expires, a stock right certificate can be sold or traded in the market like any other security.

Entry at the time of issuing stock rights

Companies record the right issue through a memorandum entry only. They don’t pass a formal journal entry at the time of right issue because they have not yet actually issued the new shares and received the cash. The memo entry indicates the number of rights the company has issued to its existing stockholders and ensures that the unissued shares have been registered for issuance in case the stockholders exercise their rights.

Entry when stockholders exercise their rights

When stockholders exercise their stock rights, the company issues additional shares in accordance with the number of shares mentioned on their stock right certificates and receives cash from them. The journal entry is made as follows:

If the cash received is equal to par value of shares:

Cash [Dr]

Common stock [Cr]

If the cash received is more than par value of shares:

Cash [Dr]

Paid-in Capital in Excess of Par—Common Stock [Cr]

Common stock [Cr]

If the cash received is less than par value of shares:

Cash [Dr]

Paid-in Capital in Excess of Par—Common Stock [Dr]

Common stock [Cr]

Leave a comment