Average costing method

Under average costing method, the average cost of all similar items in the inventory is computed and used to assign cost to each unit sold. Like FIFO and LIFO methods, this method can also be used in both perpetual inventory system and periodic inventory system.

Average costing method in periodic inventory system:

When average costing method is used in a periodic inventory system, the cost of goods sold and the cost of ending inventory is computed using weighted average unit cost. Weighted average unit cost is computed by using the following formula:

Weighted average unit cost = Total cost of units available for sale / Number of units available for sale

Example:

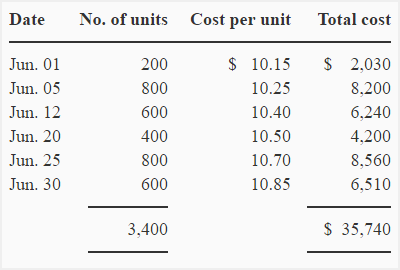

The Meta company is a trading company that purchases and sells a single product – product X. The company has the following record of sales and purchases of product X for the month of June 2013.

June 01: Balance on hand at the beginning of the month; 200 units @ $10.15.

June 05: Purchased 800 units @ $10.25.

June 07: Sold 400 units.

June 12: Purchases: 600 units @ $10.40.

June 14: Sales: 500 units

June 20: Purchases: 400 units @ $10.50

June 25: Purchases: 800 units @ $10.70

June 26: Sales: 1,400 units

June 28: Sales: 200 units

June 30: Purchases: 600 units @ $10.85

Required: Compute inventory cost at June 30, 2013 using average cost method assuming the Meta company uses periodic inventory system.

Solution:

Units available for sale:

Weighted average unit cost = $35,740 / 3,400 units

= $10.51176 per unit

Units in ending inventory = Total units available for sale – Total units sold during the period

= 3,400 units – (400 units + 500 units + 1,400 units + 200 units)

= 3,400 units – 2,500 units

= 900 units

Cost of goods sold: 2,500 units × $10.51176 = $26,279.40

Cost of ending inventory: 900 units × $10.51176 = $9,460.60

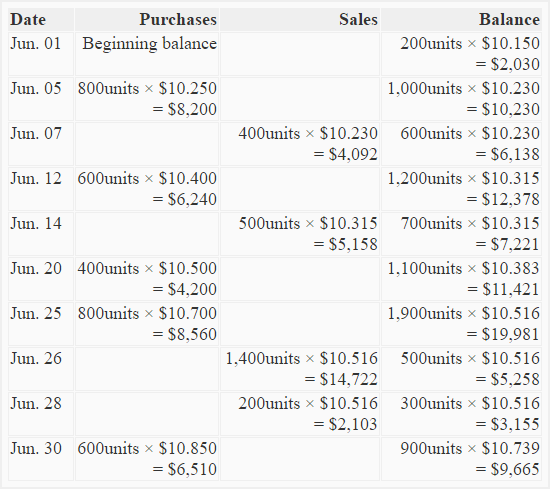

Average costing method in perpetual inventory system:

When average costing method is used in a perpetual inventory system, an average unit cost figure is computed each time a purchase is made. This average unit cost figure is then used to assign cost to each unit sold until a new purchase is made. This technique is also referred to as moving average method.

Using the data from above example, we can compute the cost of goods sold and the cost of ending inventory as follows:

Solution:

Cost of goods sold: $4,092 + $5,158 + $14722 + $2,103 = $26,075 (Total of sales column)

Cost of ending inventory: $9,665 (Balance column)

The use of average costing method in perpetual inventory system is not common among companies.

The main advantage of using average costing method is that it is simple and easy to apply. Moreover, the chances of income manipulation are less under this method than under other inventory valuation methods.

Leave a comment