Exercise-7 (Variable and absorption costing unit product cost and income statement)

Learning objectives:

This exercise illustrates the computation of per unit cost and the preparation of income statement under both variable costing and absorption costing. It also illustrates the reconciliation of variable costing and absorption costing net operating income by preparing a reconciliation schedule.

ZKB Company manufactures a unique device that is used by internet users to boost Wi-Fi signals. The following data relates to the first month of operation:

- Beginning inventory: 0 units

- Ending inventory: 5,000 units

- Units produced: 40,000 units

- Units sold: 35,000 units

- Selling price: $120 per unit

Manufacturing costs:

- Direct materials cost per unit: $30

- Direct labor cost per unit: $14

- Variable manufacturing overhead cost per unit: $4

- Fixed manufacturing overhead cost per month: $1,280,000

Marketing and administrative expenses:

- Variable marketing and administrative expenses per unit: $4

- Fixed marketing and administrative expenses per month: $1,120,000

Management is anxious to see the success of new booster in terms of its revenue and profitability.

Required:

- Calculate unit product cost under variable and absorption costing.

- Prepare the income statement under two costing systems.

- Prepare a schedule to reconcile the net operating income under variable and absorption costing.

Solution:

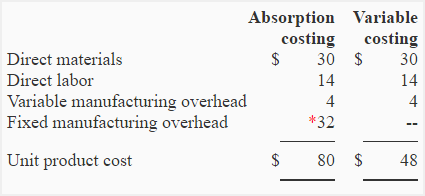

(1) Calculation of unit product cost:

*Per unit fixed manufacturing overhead cost:

= $1,280,000/40,000 units

= $32

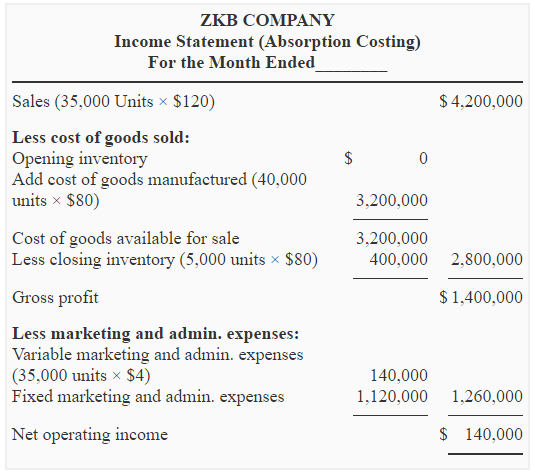

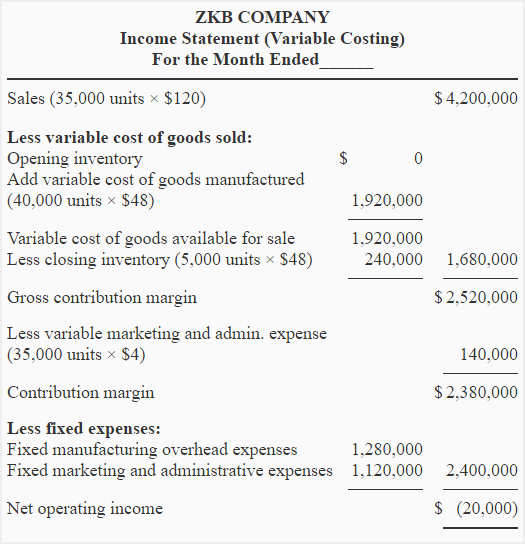

(2) Income statement:

a. Absorption costing income statement:

b. Variable costing income statement:

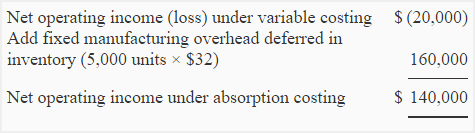

(3) Reconciliation of net operating income:

The difference in net operating income can be explained by the $160,000 in fixed manufacturing overhead deferred in inventory under the absorption costing method. The reconciliation schedule can be prepared as follows:

good lesson