Earnings per share (EPS) ratio

Earnings per share (EPS) ratio measures how many dollars of net income have been earned by each share of common stock during a certain time period. It is computed by dividing net income less preferred dividend by the number of shares of common stock outstanding during the period. It is a popular measure of overall profitability of the company and is expressed in dollars.

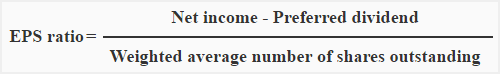

Formula:

Earnings per share ratio (EPS ratio) is computed by the following formula:

The numerator is the net income available for common stockholders (i.e., net income less preferred dividend) and the denominator is the average number of shares of common stock outstanding during the year. The denominator does not include preferred shares.

The formula of EPS ratio is similar to the formula of return on common stockholders’ equity ratio except the denominator of EPS ratio formula is the number of average shares of common stock outstanding rather than the average common stockholders’ equity in dollar amount.

Examples

Example 1 – EPS computation without preferred stock:

Abraham Company had a net income of $600,000 for the year 2019. The weighted average number of shares of common stock outstanding for the year were 200,000. What was the earnings per share ratio of Abraham Company?

Solution

Earnings per share = Net income/Weighted average number of shares outstanding

=$600,000/200,000

= $3.00 per share

Example 2 – EPS computation with cumulative preferred stock:

Following data has been extracted from the financial statements of Peter Electronics Limited. You are required to compute the earnings per share ratio of the company for the year 2016.

- Net income for the year 2016: $1,500,000

- 6% cumulative preferred stock outstanding on December 31, 2016: $3,000,000

- $15 par value common stock outstanding on December 31, 2016: $2,376,000

The number of shares of both types of stock are same as they were on January 01, 2016 because the company has not issued any new shares of common or preferred stock during the year 2016.

Solution:

From the above data, we can compute the earnings per share (EPS) ratio as follows:

= ($1,500,000 – $180,000*)/158,400

= $1,320,000/158,400

= 8.33 per share

The EPS ratio of Peter Electronics is 8.33 which means every share of company’s common stock has earned 8.33 dollars of net income during the year 2016.

* Dividend on preferred stock: $3000,000 × 0.06 = $180,000

Impact of preferred dividends on computation of earnings per share (EPS)

The dividends on cumulative and non-cumulative preferred stock impact the computation of earnings per share differently. The dividend on cumulative preferred stock for current period is always deducted from net income while computing current period’s EPS even if management does not declare any divided during the period. However, in case of non-cumulative preferred stock, the dividend is not deducted from current period’s net income unless it is declared by management.

In example 2 above, notice that no information regarding declaration of dividend has been provided. Since the preferred stock given in the example is cumulative, we have deducted the preferred stock dividend of $180,000 (= $3000,000 × 0.06) from net income to obtain the net income available for common stockholders (i.e., $1,320,000).

The dividends in arrears on cumulative preferred stock for previous periods are not deducted from current period’s net income while computing earnings per share of current period. It is because those dividends should have been deducted from the net income of previous periods for computing EPS of those periods.

Significance and Interpretation:

The shares are normally purchased to earn dividend or sell them at a higher price in future. EPS figure is extremely important for actual and potential common stockholders because the payment of dividend and increase in the value of stock in future largely depends on the earning power of the company. EPS is the most widely quoted and relied figure by analysts, stockholders and potential investors. In many countries, the public companies are legally required to report this figure on the income statement. It is usually reported below the net income figure.

There is no rule of thumb to interpret earnings per share of a company. The higher the EPS figure, the better it is. A higher EPS is the sign of higher earnings, strong financial position and, therefore, a reliable company for investors to invest their money.

EPS figure for only a single accounting period does not reveal the real earning potential of the business and should not be considered enough for making an investment decision. For a meaningful analysis, the analyst or investor should calculate the EPS figure for a number of years and also compare it with the EPS figure of other similar companies in the industry. A consistent improvement in the EPS figure year after year is the indication of continuous improvement in the earning power of the company.

Analysts, investors and potential stockholders prefer to use earnings per share ratio in conjunction with other relevant ratios. For example, EPS figure is often compared with company’s per share price by computing price earnings ratio (usually abbreviated as P/E ratio). The P/E ratio comparison of different companies reveals the reasonability of the market price of a company’s stock. It indicates whether a particular company’s stock at a certain market price is cheap or expensive in relation to similar companies’ stocks trading in the market. Other matrices that are mostly considered along with earnings per share ratio to judge the justification of stock price include dividend yield ratio and annual dividend per share.

Leave a comment