Exercise-7: Market value method for joint cost allocation and reversal cost method for by products

Abraham Company produces three products – product A, Product B and Product C. Product A and B are the joint products. Product C has a relatively small market value and is therefore treated as a by-product.

During March, 8,000 units of product A, 10,000 units of product B and 2,000 units of product C were processed in refining department. The joint processing cost incurred in the refining department was 204,000.

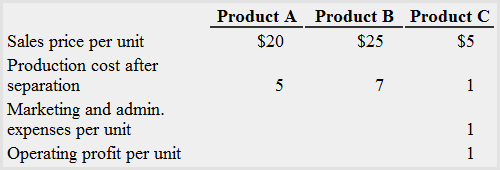

Some additional data is given below:

Abraham Company uses market value method to assign cost to product A and product B and reversal cost method to allocate cost to product C.

Required: Allocate joint cost to by-product C and joint product A and B.

Solution

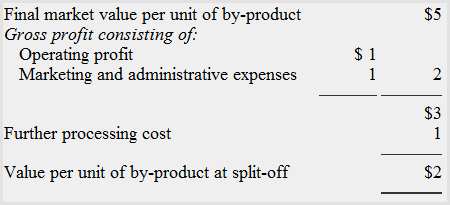

1. Allocation of cost to by-product (i.e., product C):

Value of by-product (i.e., product C) to be credited to joint cost:

Number of units produced × Value per unit of by-product at split-off

= 2,000 units × $2

$4,000

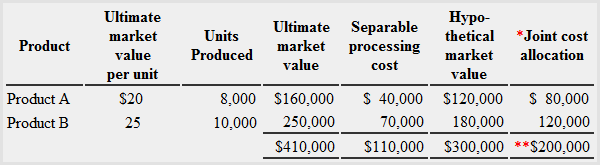

2. Apportionment of cost to joint product A and B:

*Ratio to allocate cost prior to separation

**Total joint cost less value credited to by-product ($204,000 – $4,000 = $200,000)

Leave a comment