Exercise-6: Joint cost allocation – net realizable value (NRV) method

The Western Corporation manufactures product M and product N by processing a single raw material through a common manufacturing process. Product M is sold for $50 per unit and product N is sold for $95 per unit.

After split-off point, both the products require significant further processing before they can be marketed and sold to customers. The processing cost after split-off point for product M and product N is $10 and $20 respectively.

During the month of August, 50,000 units of product M and 40,000 units of product N were completed. The total joint production cost for August was $1,800,000. There were no inventories of raw materials and finished goods on hand at the start and end of the month.

Required:

- Allocate the joint cost of $1,800,000 to product M and Product N using net realizable value (NRV) method. Also compute per unit manufacturing cost for each product.

- In which situations the use of net realizable value (NRV) method is appropriate to allocate joint production cost?

Solution

1. Allocation of joint cost using net realizable value method

The allocation of joint cost under NRV method involves the following four steps:

Step 1: Computation of net realizable value

Net realizable value = Final sales price – Processing cost after split-off

Net realizable value of product M:

Sales value – Processing cost after split-off

= (50,000 units × $50) – (50,000 units × $10)

= $2,500,000 – $500,000

= $2,000,000

Net realizable value of product N:

= Sales value – Processing cost after split-off

= (40,000 units × $95) – (40,000 units × $20)

= $3,800,000 – $800,000

= $3,000,000

Total net realizable value:

= $2,000,000 + $3,000,000

= $5,000,000

Step 2: Computation of joint cost allocation ratio

Product M:

= $2,000,000/$5,000,000

= 0.4

Product N:

= $3000,000/$5000,000

= 0.6

Step 3: Allocation of joint cost

Product M:

= $1,800,000 × 0.4

= $720,000

Product N:

= $1,800,000 × 0.6

= $1,080,000

Step 4: Per unit cost

Product M:

= ($500,000 + $720,000)/50,000 units

= $1,220,000/50,000 units

= $24.40 per unit

Product N:

= ($800,000 + $1,080,000)/40,000 units

= $1,880,000/40,000 units

= $47.00 per unit

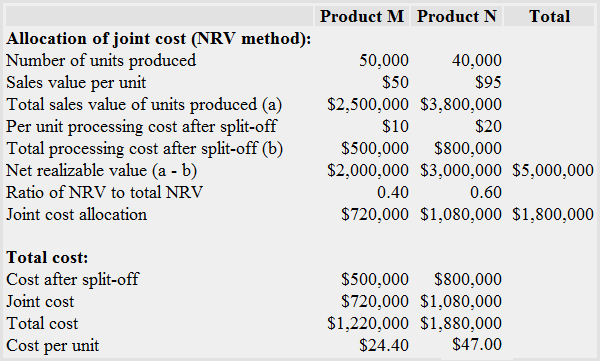

Alternatively, the solution can be presented in the following format:

2. Use of net realizable value method

The net realizable value (NRV) method allocates joint cost on the basis of net realizable value (also referred to as hypothetical sales value). This method is useful in situations where one or more products cannot be sold at split-off point.

Leave a comment