Exercise-8: Market value at the split-off point for joint cost allocation

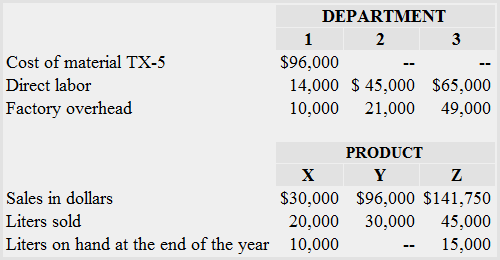

Roberts Company purchases a material known as TX-5 @ $0.80 per liter. The company has three production departments. In department 1, the material TX-5 splits off into three different products – product X, product Y and product Z. Product X is sold to customers immediately after split-off where as products Y and Z are further processed before they can be sold to customers. Product Y is processed in department 2 and product Z is processed in department 3. The related data for the last year is given below:

There were no material TX-5 and finished goods inventories at the start of the last year. The whole quantity of material TX-5 purchased during the year had been used till the end of the year. No factory overhead variances occurred in the last year. There were no work in process inventories at the start and end of the year.

Roberts always uses market value at split-off point to allocate joint cost to all of its joint products.

Required:

- For product X, find the market value at split-off of total units produced during the year.

- What is the total joint cost for the last year to be allocated among three products.

- Find the total cost of products X, Y and Z produced during the last year.

- Compute the cost assigned to products X, Y and Z ending inventory.

Solution

1. Product x – market value at split off point:

Market value per unit × Units produced during the year

= *$1.50 × 30,000 units**

= $45,000

*$30,000/20,000 units

**20,000 units sold + 10,000 units on hand

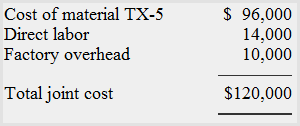

2. Total joint cost to be allocated:

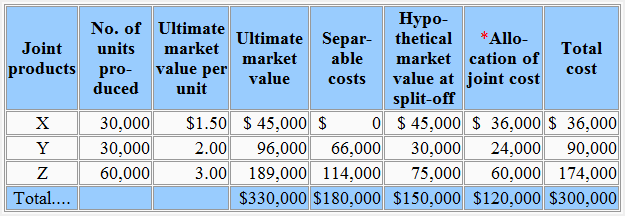

3. Total cost of products X, Y and Z produced during the year:

*Joint cost is 80% of hypothetical market value.

Hypothetical market value is equal to ultimate market value less separable production costs.

4. Cost assigned to product X and Z ending inventory:

Product X:

Cost per unit × Units in ending inventory

= *$1.20 × 10,000 units

= $12,000

*Total cost of product X as per solution to requirement 3/Number of units produced

= $36,000/30,000 units

= $1.20

Product Z:

Cost per unit × Units in ending inventory

= *$2.90 × 15,000 units

= $43,500

*Total cost of product Z as per solution to requirement 3/Number of units produced

= $174,000/60,000 units

= $2.90

Leave a comment