Journal entries in the books of consignor

In consignment, the consignor sends goods to the consignee either at cost price or at a higher price known as invoice price. The accounting procedure used under cost price method is a little bit different from that used under invoice price method. We will discuss and exemplify both the methods one by one. Let’s start with the cost price method in this article.

Cost price method – journal entries

When a consignor uses cost price method for accounting procedure of his consignment business, he makes the following journal entries in his books:

1. Entry when consignor dispatches goods to the consignee:

Consignment A/C [Dr]

Goods sent on consignment A/C [Cr]

2. Entry when consignor incurs consignment related expenses:

(i) If expenses are paid immediately:

Consignment A/C [Dr]

Cash/bank A/C [Cr]

(ii). If expenses are not paid immediately:

Consignment A/C [Dr]

Accounts payable for expenses A/C [Cr]

3. Entry when consignee sends some money as advance:

(i). If consignee sends cash or a bank draft to consignor as a mode of advance payment:

Cash/bank A/C [Dr]

Consignee A/C [Cr]

(ii). If consignee accepts a bill of exchange instead of sending cash or a bank draft:

Bill receivable A/C [Dr]

Consignee A/C [Cr]

4. Entry to record the sales made by consignee:

Consignee A/C [Dr]

Consignment A/C [Cr]

5. Entry to record the expenses paid by consignee:

Consignment A/C [Dr]

Consignee A/C [Cr]

6. Entry to record the commission charged by consignee:

Consignment A/C [Dr]

Consignee A/C [Cr]

7. To record the remittances received from consignee:

Cash/bank A/C [Dr]

Consignee A/C [Cr]

Entries 4, 5,6 and 7 are made on the basis of information provided by account sales which is received from the consignee.

8. Entry to close ‘consignment account’:

(i) In case consignment account shows a profit:

Consignment A/C [Dr]

Profit and loss on consignment A/C [Cr]

(ii). In case consignment account shows a loss:

Profit and loss on consignment A/C [Dr]

Consignment A/C [Cr]

9. Entry to close ‘goods sent on consignment account’:

The goods sent on consignment account is closed at the end of the financial year by making one of the following journal entries:

(i). In case the consignor is a manufacturer of goods:

Goods sent on consignment A/C [Dr]

Trading A/C [Cr]

(ii). In case the consignor is a wholesaler of goods:

Goods sent on consignment A/C [Dr]

Purchase A/C [Cr]

Example

On May 1, 2020, Mr. John of Alberta sends 5,000 boxes of coffee to James of Ontario on consignment basis. Each coffee box costs $100. John pays truck freight $500 and insurance $250.

After dispatching the goods to James, John immediately draws a bill of exchange for $200,000 on James who duly accepts the same and returns to John. On November 30, 2020, James forwards an account sales to John which reveals the following information:

- Sale of 3,000 boxes @ $120 per box

- Sale of 2,000 boxes @ $125 per box

- Carriage $300

- warehouse rent $375

- 10% commission on gross sales proceeds $61,000

James encloses with the account sales a check for the balance due.

Assume that the bill of exchange drawn by John is duly met by James. Also assume that the John closes his books on December 31 each year.

Required: Prepare journal entries in the books of Mr. John (the consignor) and also draw necessary ledger accounts.

Solution

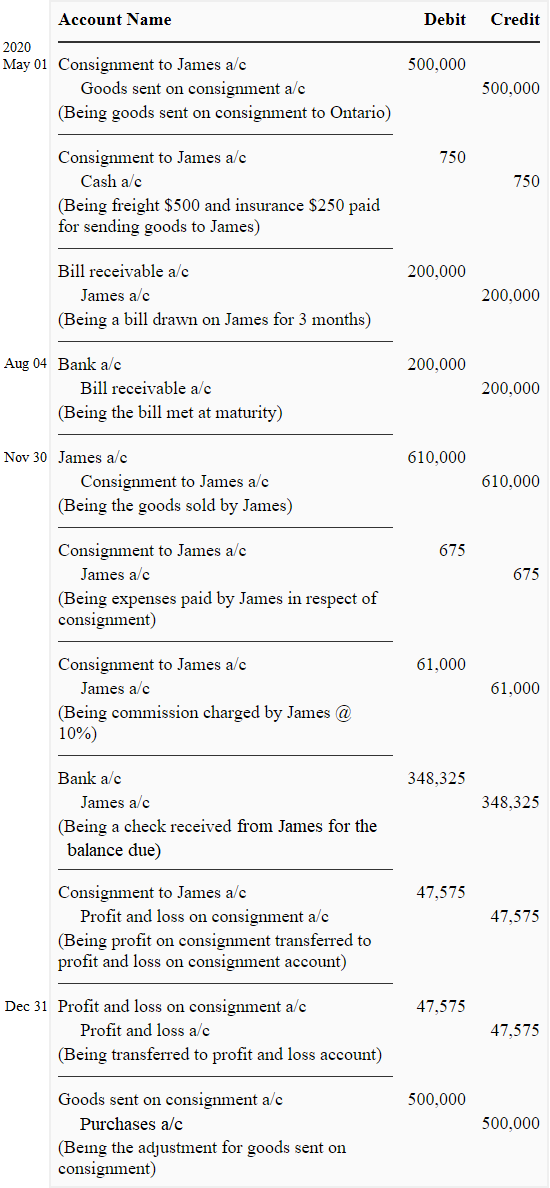

1. Journal entries in the books of John

2. Ledger accounts in the books of John

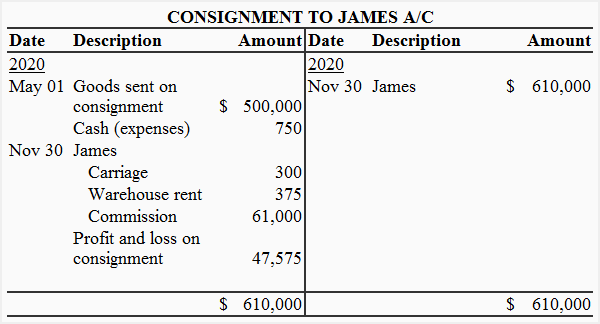

(i). Consignment to John account

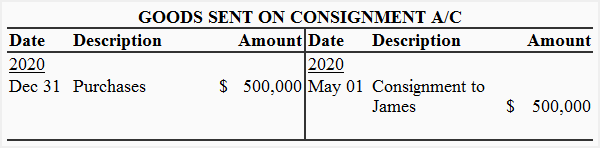

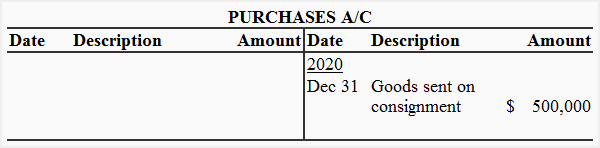

(ii). Goods sent on consignment account

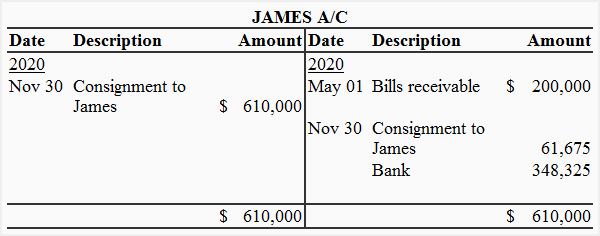

(iii). James account (consignee’s account)

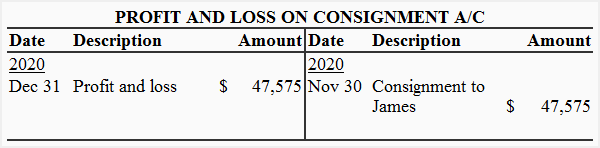

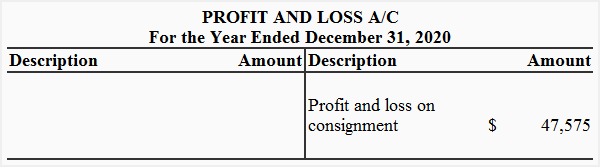

(iv). Profit and loss on consignment account

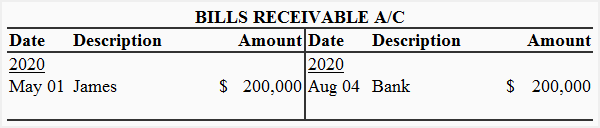

(v). Bills receivable account

(vi) Purchases account:

(vii). Profit and loss account (extract)

Leave a comment