Impact of income tax on capital budgeting decisions

The income tax usually has a significant impact on the cash flow of a company and therefore needs to be taken into account while making capital budgeting decisions. An investment that looks desirable without considering income tax may become unacceptable after considering it. Before explaining the impact of income tax on capital budgeting decisions using a net present value (NPV) example, we need to understand three important concepts. These concepts are after-tax benefit, after-tax cost and depreciation tax shield. Let’s briefly explain and exemplify each and then apply them in the computation of a NPV of a project.

After-tax benefit or cash inflow:

Taxable revenues or cash inflows, when reduced by the income tax, are known as after-tax benefit or after-tax cash inflow. When income tax is considered in capital budgeting decisions, we use after-tax cash inflow. An example of taxable cash inflow is cash generated by a company from its operations.

After tax benefit or after tax cash inflow can be easily computed using the following formula:

After-tax benefit or after-tax cash inflow = (1 – Tax rate) × Taxable cash receipt

Example 1:

XYZ company generated $500,000 cash from its operations. The tax rate of the company is 40%. Compute after-tax cash inflow.

Solution:

After-tax benefit or after-tax cash inflow = (1 – Tax rate) × Taxable cash receipt

= (1 – 0.4) × $500,000

= 0.6 × $500,000

= $300,000

After-tax cost or expense:

A tax deductible cost or expense reduces taxable income of the entity and helps save its income tax. A cost, net of its tax effect, is known as after-tax cost and can be computed using the following formula:

After-tax cost or after tax cash outflow = (1 – Tax rate) × Tax deductible cash expense

Example 2:

A company wants to start a training program that will cost it $70,000. The cost of training program is a tax deductible cost for the company. Compute after-tax cost of training program if tax rate of the company is 40%.

Solution:

After-tax cost or after tax cash outflow = (1 – Tax rate) × Tax deductible cash expense

= (1 – 0.4) × $70,000

= 0.6 × $70,000

= $42,000

The before-tax cost of training program is $70,000 and after-tax (or net-of-tax) cost of training program is $42,000.

Depreciation tax shield:

Depreciation is a non-cash tax deductible expense that saves income tax for business entities by reducing their taxable income. The amount of tax that the annual depreciation of an entity saves is known as depreciation tax shield. The formula to compute depreciation tax shield is as follows:

Depreciation tax shield = Tax rate × Depreciation deduction

Example 3:

The annual tax deductible depreciation expense of a company is $50,000 and its tax rate is 40%. Compute tax savings from depreciation (i.e., depreciation tax shield).

Solution:

Depreciation tax shield = Tax rate × Depreciation deduction

= 0.4 × $50,000

= $20,000

At 40% tax rate, a $50,000 annual depreciation charge will result in $20,000 tax shield for the company.

Capital budgeting with income tax:

Since we have learned the concept of after-tax cash inflow, after-tax cost and depreciation tax shield, now we can explain the impact of income tax on capital budgeting with the help of a comprehensive NPV example.

Example 4:

A company is considering the purchase of an equipment to save its manufacturing costs. The relevant data for net present value analysis of the equipment is given below:

- Cost of the equipment: $240,000

- Expected annual cash savings before tax to be provided by the equipment: $100,000

- Useful life of the equipment: 6 years

- Expected residual or salvage value of the equipment at the end of 6 year period: $30,000

- Tax rate: 40%

- Discount rate: 12%

The equipment is to be depreciated using straight line method of depreciation. The company does not deduct salvage value from the cost of the equipment to compute depreciation for tax purpose.

Required: Determine the net present value (NPV) of the investment. (Incorporate the impact of income tax in your solution).

Solution:

Step 1 – calculation of annual depreciation:

Annual depreciation = $240,000/6 years

= $40,000

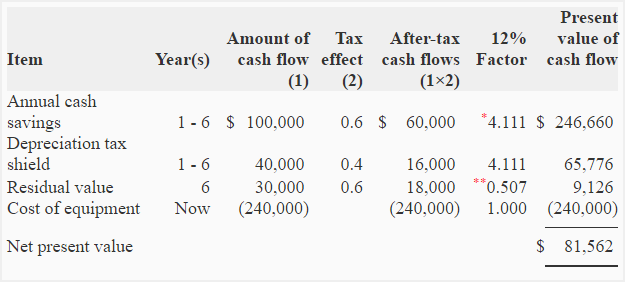

Step 2 – calculation of net present value (NPV):

* Value from present value of an annuity of $1 in arrears table.

** Value from present value of $1 table.

Notes to the solution:

- This is a cost-cutting proposal. Hence, the annual cash savings have been treated similar to annual cash inflows.

- Residual or salvage value is taxable because it has not been considered while computing the annual depreciation expense. The equipment will have a book value of zero at the end of its useful life.

We can also present the solution in horizontal format as follows:

[($100,000 x 0.6 x 4.111) + ($40,000 x 0.4 x 4.111) + ($30,000 x 0.6 x 0.507)] – ($240,000 x 1.000)

= [$246,660 + $65,776 + $9,126] – $240,000

= $321,562 – $240,000

= $81,562 NPV

How was tax effect obtained?