Gross profit analysis

Contents:

- Definition and explanation

- Procedure of gross profit analysis

- Example

- Usefulness of gross profit analysis

Definition and explanation

Before talking about gross profit analysis, we need to briefly explain what is gross profit. Gross profit is the difference between net sales and cost of goods sold and is computed as a part of income statement or profit and loss account of a business. It is computed for a specific period by deducting the cost of goods sold (COGS) from net sales revenue realized during that period. In equation form, it can be presented as follows:

Gross profit = Nets sales revenue – Cost of goods sold

For example, if the annual net sales revenue of a company is $1,000,000 and its cost of goods sold is $600,000, the gross profit would be $400,000 (= $1000,000 – $600,000). The gross profit figure is very important for any business because it is used to cover all operating expenses and provide for operating profit. The higher the gross profit, the better it is.

A company or firm may experience a significant positive or negative change in gross profit. In order to maintain profitability and avoid operating losses, any unexpected or significant change in gross profit for a period must be timely investigated.

Gross profit analysis is the procedure of finding the causes of changes in gross profit percentage from budgeted to actual or from one period to another period. The major purpose of gross profit analysis is to reveal the unexpected changes in gross profit and their causes so that they can be brought to the attention of management in a timely manner. A change in gross profit usually occurs due to one or more of the following reasons:

- Changes in total revenue for the period due to changes in selling prices of goods and services.

- Changes in total revenue for the period due to changes in quantity of goods and services sold during the period.

- Changes in proportion in which a multi-product company sells its products (usually termed as shift in sales mix or product mix).

- Changes in basic manufacturing cost elements i.e., direct materials, direct labor and manufacturing overhead.

Procedure of gross profit analysis

The procedure of determining the gross profit variation is identical to the computation of variances in a standard costing system. However, the gross profit analysis is possible without the use of budgets or standard costs. In that case, the prices and costs data of any year may be used as the basis for the computations of variances involved in gross profit analysis. The usual approach is to use the prices and costs of any previous year as the basis to find the variations. However, to achieve a greater degree of accuracy and better results, it is always recommended to employ standard costs and budgeted figures to carry out the analysis.

Variances involved in gross profit analysis

For performing a gross profit analysis, the standard sales and cost figures (or a previous year’s sales and cost figures) are used as the basis. The analysis is performed in three steps. In first step, the sales price variance and the sales volume variance are computed. In second step, the cost price variance and cost volume variance are computed. In third step, the sales volume variance and cost volume variance are further analyzed by computing sales mix variance and a final sales volume variance.

Example

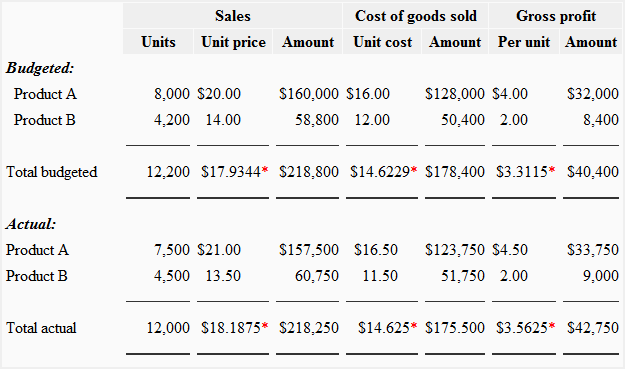

The Steward Company manufactures to products – product A and product B. The budgeted and actual data for the last month is provided below:

Required: Using the data of Steward Company given above, compute:

- sales price variance and sales volume variance

- cost price variance and cost volume variance

- sales mix variance and final sales volume variance

Solution

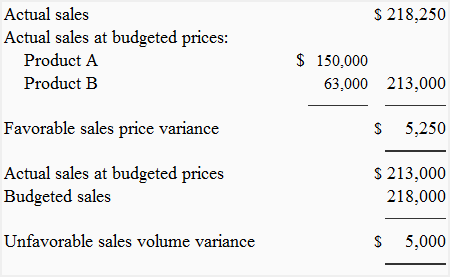

1. Sales price variance and sales volume variance

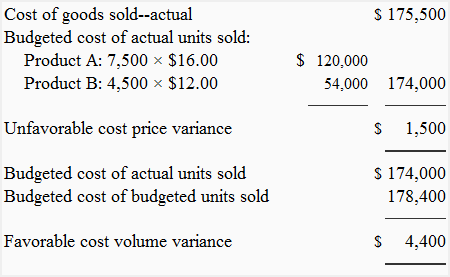

2. Cost price variance and cost volume variance

Interim recapitulation:

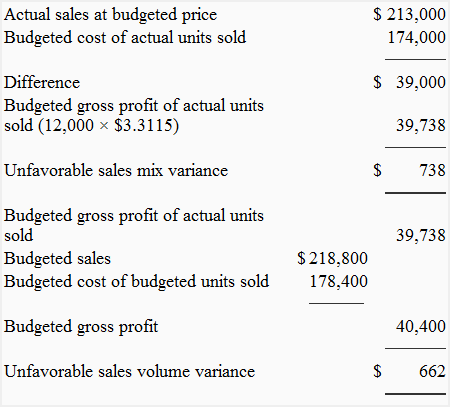

3. Sales mix variance and final sales volume variance

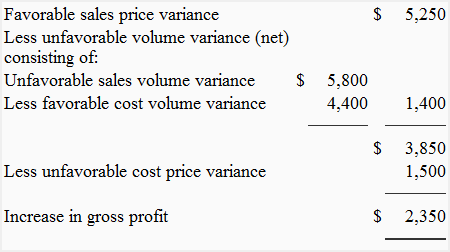

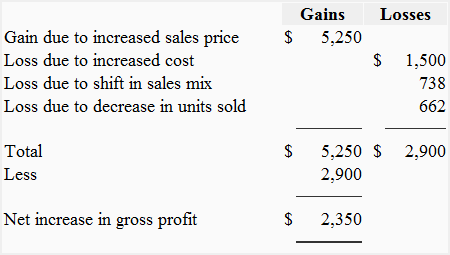

Final recapitulation:

Usefulness of gross profit analysis

The gross profit figure is very important for any business and must be closely watched. The gross profit analysis uncovers inefficiencies in company’s performance during the period and enables management to take remedial actions to correct the situation. The manufacturing and marketing departments of business are mostly responsible to meet or exceed the planned gross profit. In case the business fails to achieve the desired gross profit, the manufacturing department must explain the changes in manufacturing costs and marketing department must explain the changes in prices, decrease in number of units of each product sold and/or shift in sales mix during the period. This way, the gross profit analysis brings together the two major functional areas of the business and focuses on the need of more study by these two departments.

Leave a comment