Exercise 7: Quantity schedule, cost per equivalent units – FIFO method

Learning objective:

This exercise illustrates the preparation of quantity schedule and the computation of cost per equivalent unit under the FIFO method.

Hotex Company produces a chemical to be used in the production of pesticides. The company is currently using the weighted average method to prepare production reports for all of its processing departments. The company’s CEO is interested in knowing how converting from the weighted average method to the FIFO method would impact the preparation of the quantity schedule, the determination of equivalent units, and the computation of cost per equivalent unit.

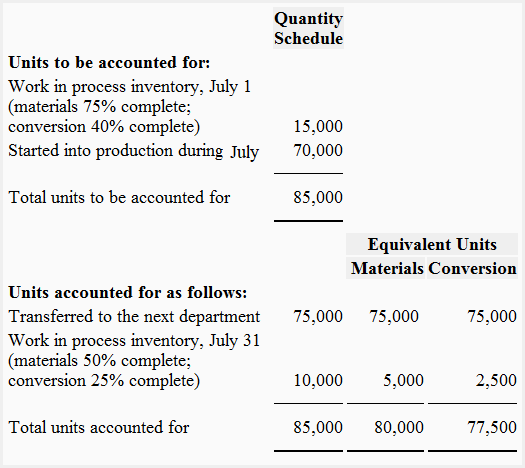

The quantity schedule and the number of equivalent units determined using the weighted average method for July for the first department are given below:

Quantity schedule and equivalent units – weighted average method:

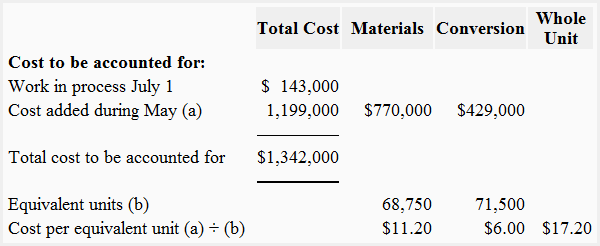

The selected cost data related to the first department is given below:

Cost in work-in-process (WIP) inventory on July 1:

- Materials cost: $113,200

- Conversion cost: $29,800

Cost added by the first department during July:

- Materials cost: $770,000

- Conversion cost: $429,000

Required:

- Prepare a quantity schedule and determine the equivalent units of production using the FIFO method.

- Compute the cost per equivalent unit for July for the first department using the FIFO method.

Solution

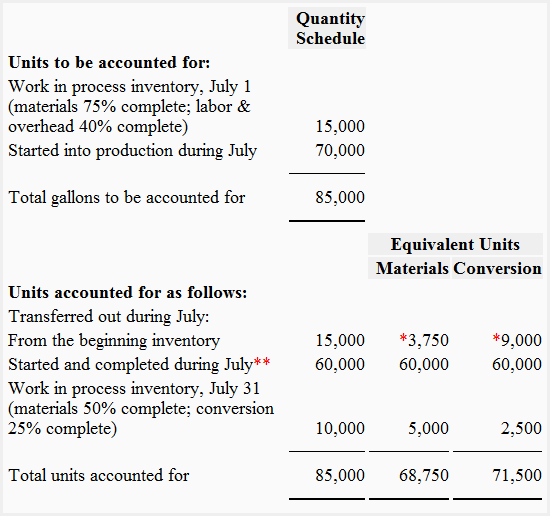

1. Quantity schedule and equivalent units – FIFO method

*Work done in July:

25% (= 100% – 75%) with respect to materials and 60% (= 100% – 40%) with respect to conversion.

**Started and completed during July:

= Units started – Work in process ending inventory

= 70,000 – 10,000

= 60,000

Or

= Units transferred out – Work in process beginning inventory

= 75,000 – 15,000

= 60,000

2. Cost per equivalent unit – FIFO method

Leave a comment