Exercise 8: Cost reconciliation schedule – FIFO method

Learning objective:

This exercise illustrates the preparation of a cost reconciliation schedule under the FIFO method

In this exercise, we have used the data of Hotex Company from Exercise 7. If you have directly come to this exercise, we recommend you try to solve Exercise 7 first and then come back to this exercise to continue.

Hotex Company presents you the following information for July for the first processing department:

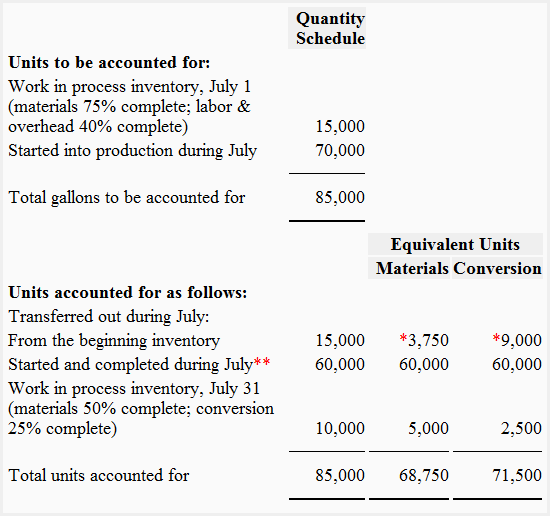

Quantity schedule and equivalent units – FIFO method – (data taken from exercise 7):

*Work done in July:

25% (= 100% – 75%) with respect to materials and 60% (= 100% – 40%) with respect to conversion.

**Started and completed during July

= Units started – Work in process ending inventory

= 70,000 – 10,000

= 60,000

Or

= Units transferred out – Work in process beginning inventory

= 75,000 – 15,000

= 60,000

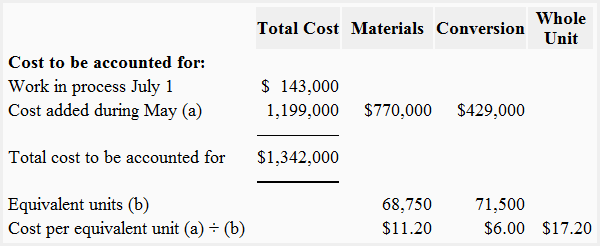

Cost per equivalent unit – FIFO method – (taken from exercise 7):

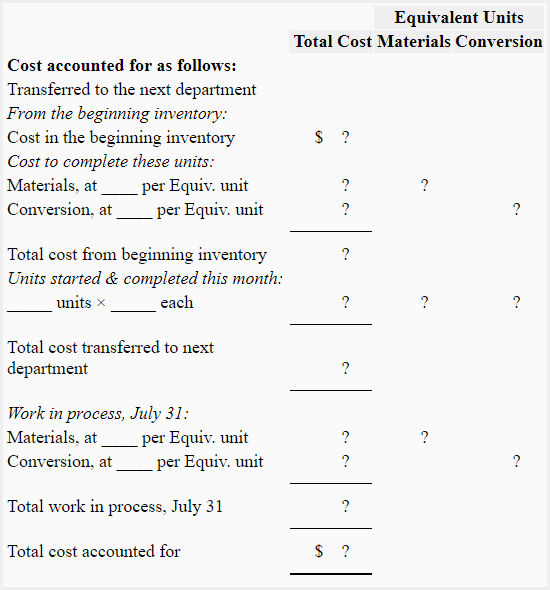

Required: Using above data, complete the following cost reconciliation schedule for July for the first processing department of Hotex Company.

Solution

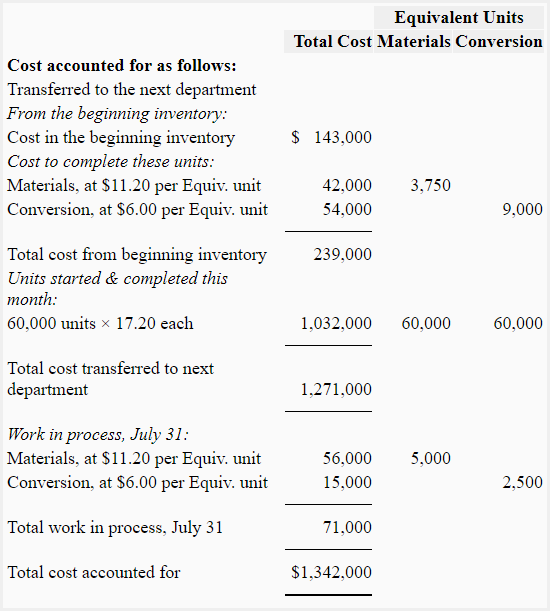

Cost reconciliation schedule – FIFO method

Hello, thank you very much for your content.

I wanted to know why are the $143,000 (Costs in the beginning inventory) taken into account in the total Cost accounted for calculation please ?

I always though that the only costs taken inot account in this calculation are the following :

– Costs to finish Beginning WIP

– Costs for Units started and Transferred during the period

– Costs to “reach” Ending WIP

Many thanks in advance for your help.

Best regards.

@ Romin Garrault

This is FIFO dear.

@RASHID JAVE

Oh thank you very much, I think I confused the total Cost accounted for and the Total costs that I have to take into account while I calculate the cost per EUP..