Exercise-10: Payback period method with salvage value

Learning objective:

This exercise illustrates the computation of payback period of installing a new fixed asset which replaces an old asset having a salvage value.

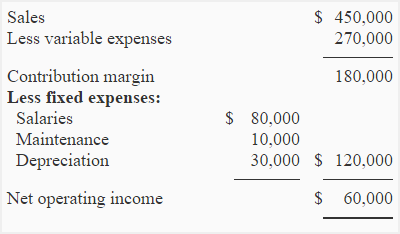

The Black Stone Company sells crushed stone to government contractors as well as to small construction businesses. The company needs to replace an old equipment with a new one. The new equipment can increase production as well as improve the quality of crushed stone. The information about annual incremental revenues and costs associated with the new equipment is given below:

The annual depreciation of $30,000 is the only non-cash expense in above income statement. The new equipment would cost $240,000 and the old equipment can be sold to a small company for its salvage value of $15,000.

Required: Would the company invest in new equipment if the management’s desired payback period is 2.5 years or less?

Solution:

We can can solve this exercise in three steps below:

Step 1 – Computation of net annual cash inflow:

The net operating income is not equal to net cash flow because it has been obtained after taking into account the depreciation – a non-cash expense. We would add the depreciation back to net operating income to get the incremental net cash inflow figure. It is shown below:

$60,000 + $30,000

= $90,000

Step 2 – Computation of investment:

The cost of new equipment is $240,000 and the salvage value of the old equipment is $15,000. The net investment required is, therefore, $225,000 (= $240,000 – $15,000).

Step 3 – Computation of payback period:

Payback period = Investment required for the project/Net annual cash inflow

= $225,000/$90,000

= 2.5 years

The equipment promises a payback period of 2.5 years which is equal to the maximum desired payback period of Black Stone Company. The equipment would, therefore, be purchased according to payback period analysis.

Leave a comment