Dividend payout ratio

Dividend payout ratio discloses what portion of the current earnings the company is paying to its stockholders in the form of dividend and what portion the company is ploughing back in the business for growth in future. It is computed by dividing the dividend per share by the earnings per share (EPS) for a specific period.

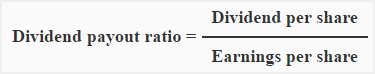

Formula:

The formula of dividend payout ratio is given below:

The numerator in the above formula is the dividend per share paid to common stockholders only. It does not include any dividend paid to preferred stockholders.

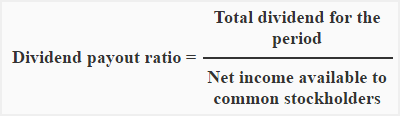

It can also be computed by dividing the total amount of dividend paid on common stock during a particular period by the total earnings available to common stockholders for that period.

Example:

The Best Buy Inc. has declared and paid a dividend of $0.66 per share of common stock. The company does not have any preferred stock outstanding. The information about common stock and net income is given below:

- Common stock (10,000 shares, $25 par value): $250,000

- Net income: $22,000

An investor seeking for continuous dividend income wants to purchase the share of the Best Buy Inc. For this purpose he requests you to compute the dividend payout ratio for him from the above information.

Solution:

= $0.66/ $2.2*

= 0.3 or 30%

*Earnings per share of common stock:

$22,000/10,000 shares

Significance and Interpretation:

A low dividend payout ratio means the company is keeping a large portion of its earnings for growth in future and a high payout ratio means the company is paying a large portion of its earnings to its common shareholders.

Whether a payout ratio is good or bad depends on the intention of the investor. A high payout ratio is usually preferred by those investors who purchase shares to earn regular dividend income and a low ratio is good for those who seek appreciation in the value of common stock in future.

Companies with ample reinvestment opportunities and a high rate of return on assets usually keep a large portion of earnings in the business and, therefore, have a low dividend payout ratio during the first few years of establishment. Well established companies usually have a good consistent dividend payout ratio.

Leave a comment