Chart of accounts (COA)

Chart of accounts (COA) is simply a list of account names that a company uses in its general ledger for recording various business transactions. It provides guidance to book-keepers, accountants or other relevant persons in using specific account names while entering transactions in journal and later posting them to ledger.

Structure or template

There is no common structure or template of chart of accounts available for the use of all types of business entities. Each company prepares its own chart of accounts depending on its individual requirements. The structure of a chart of accounts is normally as complex as the business structure of the company. For example, the type and number of accounts needed by a large corporation would significantly differ from those needed by a small retailer. Similarly many accounts that are essential in manufacturing businesses are not used by merchandising companies.

The type and number of accounts used in a chart of accounts depends on a number of factors such as the nature and volume of business carried on by the company, the need of internal management for making important business decisions and the need of external parties who use financial statements of the company for various purposes.

The account names are listed in the chart of accounts in the same order in which they appear in company’s financial statements. Usually, the balance sheet accounts (i.e., assets, liabilities and owner’s equity) are listed first and income statement accounts (i.e., revenue and expense) are listed later.

Numbering accounts in a chart of accounts

Each account in the chart of accounts is assigned a unique number for indexing and identification purpose. Normally, each account number consists of two or more digits that tell something about relevancy of the account. For example, a number starting with “1” might tell us that the account is an asset account and a number starting with “2” might tell us that the account is a liability account. Normally, appropriate gaps are provided between numbers (i.e., some numbers are left unassigned) which makes it easy to add more accounts in future without disturbing other accounts that already exist in the chart.

The organizations operating in many territories with a lot of departments usually have account numbers consisting of five or more digits. The account numbers of a company with different departments and operations might have digits to reflect the department or operation to which the particular account relates. Similarly, a company operating in different territories or regions might include a digit in its account numbers to identify the territory or region to which the accounts relate. For example, the account numbers of Procter and Gamble (a multinational consumer goods company) mostly consist of more than 30 digits to reflect different departments, operations, territories and regions etc.

Example chart of accounts of a merchandising company

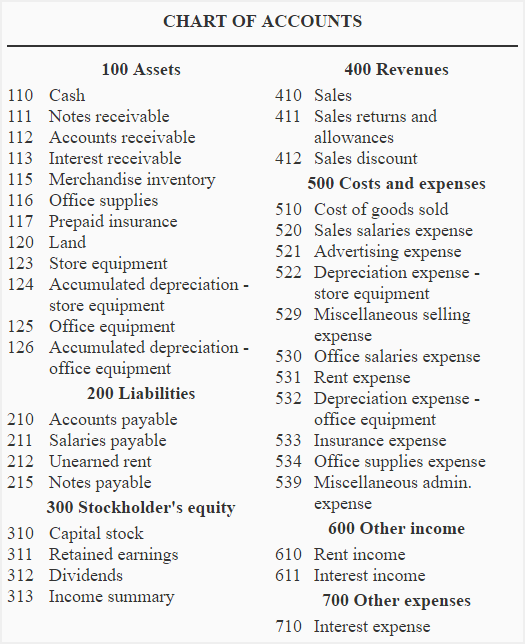

Following is an example of a simple chart of accounts that might be used by a merchandising company:

In above chart of accounts example, all the account numbers used comprise of three-digit. The first digit shows the major classification of account, the second digit shows the sub-classification and the third one identifies the specific account name. For example:

for assets:

- 1 > The account is an “asset account”.

- 11 >> The account is a “current asset account”.

- 110 >>> The account is “cash account”.

and for liabilities:

- 2 > The account is a “liability account”.

- 21 >> The account is a “current liability account”.

- 210 >>> The account is “accounts payable account”.

In above example of chart of accounts, notice that there are gaps between some account numbers. These gaps provide flexibility for adding more accounts if the company needs them in future.

Leave a comment